filmov

tv

Dr Art Laffer: 'I'm Very Concerned' About The US & Global Economy (But There's Hope...)

Показать описание

If we care about the future of the economy, then we have to pay close attention to the policies that shape it.

We are currently living in an age of extreme -- and in certain cases, unprecedented -- levels of monetary and fiscal policy.

Is that wise? Or should market forces be allowed to play out more & free us from the constant intervention of the central planners?

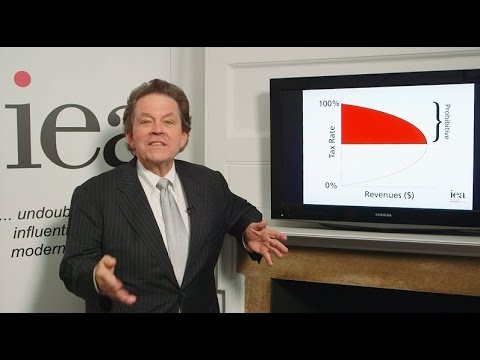

To explore this, we welcome economist Dr Arthur Laffer. Dr Laffer was the first to hold the title of Chief Economist at the Office of Management and Budget in the early 1970s. He then later served as a member of President Reagan's Economic Policy Advisory Board. He's perhaps best known for developing the Laffer curve, a model for determining the optimal balance between tax revenues and economic growth.

Dr Laffer sees the major nations of the world declining into a sclerotic senescence. BUT...he sees a way for us to reverse that plight, on a timeline that could be much faster than many imagine is possible.

The key question is: Will we have the conviction, courage and commitment to embrace the necessary reforms?

For an important discussion with a respected economic advisor to nearly every President since Nixon, watch this video with Dr Art Laffer.

#taxes #internationaltrade #economics

_____________________________________________

Thoughtful Money LLC is a Registered Investment Advisor Solicitor.

We produce educational content geared for the individual investor. It’s important to note that this content is NOT investment advice, individual or otherwise, nor should be construed as such.

We recommend that most investors, especially if inexperienced, should consider benefiting from the direction and guidance of a qualified financial advisor in good standing with the Financial Industry Regulatory Authority (FINRA) who can develop & implement a personalized financial plan based on a customer’s unique goals, needs & risk tolerance.

IMPORTANT NOTE: There are risks associated with investing in securities.

Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods.

A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Комментарии

0:50:41

0:50:41

0:50:04

0:50:04

1:27:27

1:27:27

0:49:31

0:49:31

0:37:58

0:37:58

0:09:42

0:09:42

0:04:03

0:04:03

0:05:04

0:05:04

0:03:35

0:03:35

0:04:10

0:04:10

0:07:21

0:07:21

0:06:25

0:06:25

0:52:23

0:52:23

0:47:06

0:47:06

0:47:34

0:47:34

0:04:10

0:04:10

1:13:30

1:13:30

0:08:09

0:08:09

0:56:35

0:56:35

0:09:00

0:09:00

1:29:48

1:29:48

0:07:03

0:07:03

0:04:46

0:04:46

0:16:32

0:16:32