filmov

tv

Dr Art Laffer, Charting America’s Economic Destiny in the Age of Trump

Показать описание

Dr. Arthur Laffer explores the nuts and bolts of Trumponomics and what it means for the future.

Recorded at Patrick Henry College on Tuesday, October 9, 2018.

Recorded at Patrick Henry College on Tuesday, October 9, 2018.

Dr Art Laffer, Charting America’s Economic Destiny in the Age of Trump

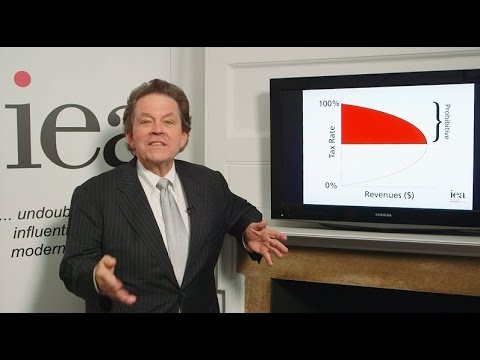

Art Laffer explains the Laffer Curve

Supply-Side Economics and American Prosperity | Official Trailer

The Story of the Laffer Curve

Dr. Arthur Laffer on the Fallacies of High Taxation

'The Economic Debate Leading into 2016' - Art Laffer

Supply-Side Economics and American Prosperity | Sneak Peek

An Outlook for the Economy | Dr. Art Laffer

Dr. Art Laffer on 'Trump, Taxes, and Trade'

Trump Awards Presidential Medal of Freedom to Economist Art Laffer

A Laffer Curve for Democracy?

Is U.S. Dollar Becoming an ‘Unhinged Paper Currency’? ‘It’s Worst It’s Ever Been!’ – Art Laffer...

Dr. Art Laffer: 'Now Is The Time For Missouri To Do The Job Right'

More free markets, more freedom: How to create a thriving economy | Arthur Laffer LIVE

Dr. Art Laffer - MSNBC - AM Joy - 10-14-2018

Laffer Curve Explained (How The Ideal Tax Rate Is Determined ?)

Dr. Art Laffer - America's Newsroom - Fox News - 02-01-2019

The Laffer Curve Paradox

Trump to award Medal of Freedom to Art Laffer

The Consequences of Taxes with Dr. Art Laffer

Art Laffer: Powell doesn't understand this

Laffer Curve I Tax Rate Vs Tax Revenue I Tax Elasticity I Tax Avoidance I Tax Evasion I Taxation

Lessons from the Reagan Revolution: The Case for Lower Taxes - Dr Arthur Laffer

Putin escalates Ukraine War, Fed tumbles markets with another hike, what’s next? - Art Laffer

Комментарии

1:27:27

1:27:27

0:03:35

0:03:35

0:02:37

0:02:37

0:06:21

0:06:21

0:47:06

0:47:06

0:52:23

0:52:23

0:03:24

0:03:24

1:17:13

1:17:13

1:13:30

1:13:30

0:14:48

0:14:48

0:02:03

0:02:03

1:23:20

1:23:20

0:01:53

0:01:53

0:58:28

0:58:28

0:07:03

0:07:03

0:03:16

0:03:16

0:05:08

0:05:08

0:00:42

0:00:42

0:04:16

0:04:16

0:43:26

0:43:26

0:07:45

0:07:45

0:07:27

0:07:27

0:49:31

0:49:31

0:33:45

0:33:45