filmov

tv

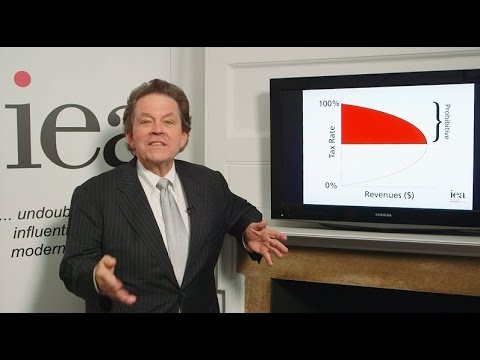

Art Laffer explains the Laffer Curve

Показать описание

Dr Art Laffer - renowned American economist - explains the Laffer Curve as the relationship between tax rates and total tax revenues.

---

---

---

---

Art Laffer explains the Laffer Curve

ECON 101 with Dr. Art Laffer

Supply-Side Economics and American Prosperity | Official Trailer

Steamboat Institute: Economist Dr. Arthur Laffer Explains What Happens When you Tax The Rich

The Story of the Laffer Curve

Episode 6 Clip : The Laffer Curve Explained by Arthur Laffer

The Redistribution Fallacy | Highlights Ep. 48

Economist Dr. Arthur Laffer Explains The Relationship Between Taxes and Economic Incentives

Art Laffer on the best way to tax the ultra rich

Art Laffer on Trump vs. Reagan

The Art of Taxes - an interview with Art Laffer

Art Laffer - Understanding our Economic Mess

Interview with Arthur Laffer

Art Laffer vs Joe Biden / The Tax Tree (The Laffer Curve Explained)

Economist Art Laffer receives Presidential Medal of Freedom

Why Wealth Redistribution FAILS | Dr. Arthur Laffer

Economist Art Laffer On How to Fix California

Economist Dr. Arthur Laffer Explains What Happens When you Raise Taxes on the Rich

Supply-Side Economics and American Prosperity | Sneak Peek

Why Raising Taxes Destroys The Economy - Art Laffer

Economist Dr. Arthur Laffer Explains How President Regan's Tax Policy Impacted America

The Story of the Laffer Curve #Shorts

Economist Dr. Arthur Laffer Gives A History Lesson of Tax Rates Leading Up to the Great Depression

Does the Laffer Curve Make Any Sense?

Комментарии

0:03:35

0:03:35

0:06:17

0:06:17

0:02:37

0:02:37

0:00:32

0:00:32

0:06:21

0:06:21

0:00:54

0:00:54

0:04:11

0:04:11

0:01:19

0:01:19

0:07:01

0:07:01

0:03:06

0:03:06

0:05:04

0:05:04

0:12:50

0:12:50

0:23:57

0:23:57

0:14:19

0:14:19

0:15:02

0:15:02

0:02:58

0:02:58

0:07:05

0:07:05

0:01:14

0:01:14

0:03:24

0:03:24

0:57:58

0:57:58

0:00:32

0:00:32

0:00:58

0:00:58

0:06:33

0:06:33

0:05:36

0:05:36