filmov

tv

New Tax Regime vs old Tax Regime for FY 2024-25 - Tamil

Показать описание

Compared New Tax Regime vs old Tax Regime, which one is best for your salary

In this video, we dive into the differences between the new tax regime and the old tax regime for the financial year 2024-25, specifically tailored for Tamil-speaking viewers. We break down the key points, benefits, and drawbacks of each regime, helping you make an informed decision on which one suits you best. Whether you're a salaried employee, self-employed, or a business owner, this video provides clear and concise information to navigate the tax landscape in Tamil Nadu. Don't forget to like, share, and subscribe for more insightful content!

In this video, we dive into the differences between the new tax regime and the old tax regime for the financial year 2024-25, specifically tailored for Tamil-speaking viewers. We break down the key points, benefits, and drawbacks of each regime, helping you make an informed decision on which one suits you best. Whether you're a salaried employee, self-employed, or a business owner, this video provides clear and concise information to navigate the tax landscape in Tamil Nadu. Don't forget to like, share, and subscribe for more insightful content!

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Which is the best tax regime for you? | Money Psychology

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

New Vs Old Tax Regime Malayalam | E filing Malayalam AY 2024-25 |CA Subin VR

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation II JP Tips II

New Tax Regime vs Old Tax Regime SIMPLIFIED

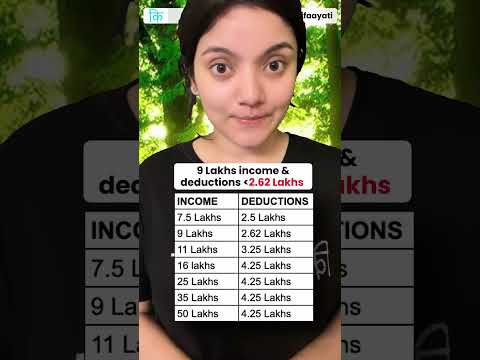

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

Old Vs New Tax Regime? Which one to choose?

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

Choose between Old Tax Regime and New Tax Regime (FY 2023-24)

Comparison of Old Tax Regime v/s New Tax regime

Old Tax or New Tax Regime - What Do I Pick? #financewithsharan #shorts

Old vs New Tax Regime | Old Tax Regime vs New Tax Regime | FY 2023-24

Old Vs New Tax Regime (Part 1)

New tax regime | How to save income tax in FY24

New vs Old Tax Regime FY 2024-25 💰 #epmshorts

Old Tax vs New Tax Regime | Which Is More Beneficial After Budget 2023?

Old Tax Regime vs. New Tax Regime: Complete Income Tax Calculation & Savings Guide

Old Tax Regime or New Tax Regime #LLAShorts 519

New or Old 💸 #epmshorts

Old Tax vs New Tax Regime (FY 2024-25):Which one would you choose? Let's understand with an exa...

Old to New, New to Old, How? #LLAShorts 527

Комментарии

0:11:02

0:11:02

0:13:35

0:13:35

0:12:34

0:12:34

0:12:38

0:12:38

0:05:24

0:05:24

0:11:53

0:11:53

0:00:44

0:00:44

0:00:47

0:00:47

0:15:28

0:15:28

0:01:00

0:01:00

0:15:14

0:15:14

0:00:52

0:00:52

0:00:20

0:00:20

0:01:01

0:01:01

0:01:01

0:01:01

0:08:04

0:08:04

0:10:48

0:10:48

0:00:59

0:00:59

0:06:41

0:06:41

0:44:04

0:44:04

0:00:45

0:00:45

0:01:01

0:01:01

0:01:30

0:01:30

0:01:00

0:01:00