filmov

tv

New vs Old Tax Regime FY 2024-25 💰 #epmshorts

Показать описание

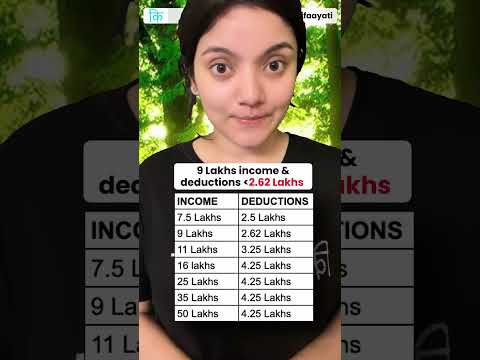

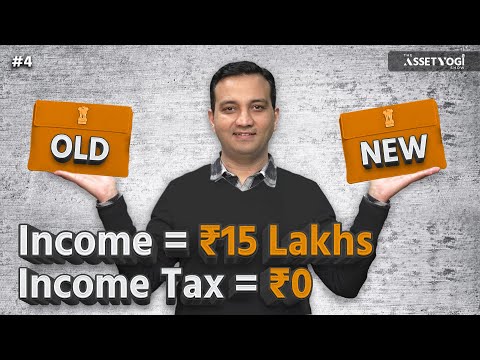

In the Union Budget 2024, the new Income Tax Slabs and Tax Rates for FY 2024-25 have been revised compared to FY 2023-24. This comparison includes detailed calculations. The new tax slabs feature lower tax rates, but all tax exemptions and deductions have been removed. Stay informed on how these changes impact your finances.

#TaxSlabs #TaxRates #IncomeTax #IncomeTaxReturn #Budget2024

#TaxSlabs #TaxRates #IncomeTax #IncomeTaxReturn #Budget2024

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Which is the best tax regime for you? | Money Psychology

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

New Vs Old Tax Regime Malayalam | E filing Malayalam AY 2024-25 |CA Subin VR

New Tax Regime vs Old Tax Regime SIMPLIFIED

Choose between Old Tax Regime and New Tax Regime (FY 2023-24)

🤯New 🤡 vs old💀 bhaiya pass comparison #foryou #freefireshorts

New vs Old Tax Regime FY 2024-25 💰 #epmshorts

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

Old Tax or New Tax Regime - What Do I Pick? #financewithsharan #shorts

New or Old 💸 #epmshorts

Old Vs New Tax Regime? Which one to choose?

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

Old vs New Tax Regime | Old Tax Regime vs New Tax Regime | FY 2023-24

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

Old Tax Regime or New Tax Regime #LLAShorts 519

Old Tax vs New Tax Regime (FY 2023-24):Which one would you choose? Let's understand with an exa...

Old to New, New to Old, How? #LLAShorts 527

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

Old Tax Regime vs. New Tax Regime: Complete Income Tax Calculation & Savings Guide

New Tax Regime vs Old Tax Regime | New vs Old Tax Regime | Which is Best Tax Regime for AY 2024-25 |

New Tax Regime vs Old Tax Regime 2024-25 | Income Tax New vs Old Tax Regime Which is Better 2023-24

Old Tax vs New Tax Regime (FY 2024-25):Which one would you choose? Let's understand with an exa...

Комментарии

0:11:02

0:11:02

0:13:35

0:13:35

0:12:34

0:12:34

0:12:38

0:12:38

0:05:24

0:05:24

0:00:47

0:00:47

0:00:52

0:00:52

0:00:12

0:00:12

0:00:59

0:00:59

0:15:28

0:15:28

0:01:01

0:01:01

0:01:01

0:01:01

0:01:00

0:01:00

0:11:53

0:11:53

0:01:01

0:01:01

0:15:14

0:15:14

0:00:45

0:00:45

0:01:00

0:01:00

0:01:00

0:01:00

0:22:57

0:22:57

0:44:04

0:44:04

0:09:12

0:09:12

0:10:27

0:10:27

0:01:30

0:01:30