filmov

tv

Why Net Present Value (NPV) and IRR are important for investing opportunities

Показать описание

Knowing how to calculate NPV and IRR are important to making any kind of investment decision. We will teach you what NPV and IRR are and how to calculate these Corporate Finance topics with simple visual examples with formulas and by excel.

All NPV and IRR are part of Time Value of Money and Capital Budgeting.

This is the 4th of 11 videos that teach Business Finance in Section 6 and is a good starting point if you are new to Finance or need a refresher.

New videos will be posted once a week, so subscribe to keep up to date!

Created by two MBAs with a combined 10+ years of experience in the professional world, we created these videos to help others who are curious about learning business or need a refresher in certain areas of business.

Make sure to subscribe and leave a comment down below saying that "I've subscribed" and we'll try to your comment. We would like to hear from you!

#businessbasics #corporatefinance #NPV #IRR #capitalbudgeting

All NPV and IRR are part of Time Value of Money and Capital Budgeting.

This is the 4th of 11 videos that teach Business Finance in Section 6 and is a good starting point if you are new to Finance or need a refresher.

New videos will be posted once a week, so subscribe to keep up to date!

Created by two MBAs with a combined 10+ years of experience in the professional world, we created these videos to help others who are curious about learning business or need a refresher in certain areas of business.

Make sure to subscribe and leave a comment down below saying that "I've subscribed" and we'll try to your comment. We would like to hear from you!

#businessbasics #corporatefinance #NPV #IRR #capitalbudgeting

Net Present Value (NPV) explained

How to calculate the Net Present value (NPV)

How to Calculate a Project's NPV?

Introduction to Net Present Value (NPV)

🔴 3 Minutes! NPV and Net Present Value Explained with NPV Example (Quickest Overview)

The Concept of Net Present Value (NPV) Explained

How to Calculate NPV (Net Present Value) in Excel

Net Present Value (NPV) in Excel Explained | Should You Accept the Project?

ACCA F9 - Investment Decisions Making Kaplan Kit Question Warden | Exam Practice Question Guide

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

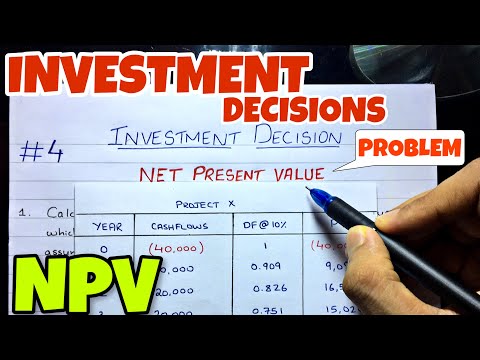

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ B.COM / BBA / CMA

Net Present Value (NPV): How to Do NPV Analysis

Net Present Value (NPV) Calculation Example Using Table | Non-constant (uneven) cash flows

NPV and IRR explained

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accounting

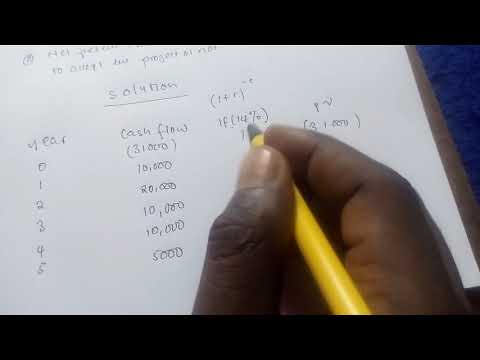

Net present value (NPV) example problem

Net Present Value Explained in Five Minutes

Why Net Present Value (NPV) and IRR are important for investing opportunities

Net Present Value (NPV) Example

What is Net Present Value (NPV) ?

What is Discounted Cash Flow (DCF)?

Nettokapitalwert berechnen - Net Present Value (NPV) [Definition + Formel + Beispiel]

BA II Plus | Cash Flows 1: Net Present Value (NPV) and IRR Calculations - DCF

Capital Budgeting: Net Present Value (NPV)

Комментарии

0:05:26

0:05:26

0:07:27

0:07:27

0:05:13

0:05:13

0:03:45

0:03:45

0:03:05

0:03:05

0:06:35

0:06:35

0:02:56

0:02:56

0:03:56

0:03:56

0:42:58

0:42:58

0:18:22

0:18:22

0:18:50

0:18:50

0:03:12

0:03:12

0:09:01

0:09:01

0:06:48

0:06:48

0:29:50

0:29:50

0:02:43

0:02:43

0:04:34

0:04:34

0:12:51

0:12:51

0:03:50

0:03:50

0:01:24

0:01:24

0:05:02

0:05:02

0:06:45

0:06:45

0:02:53

0:02:53

0:06:22

0:06:22