filmov

tv

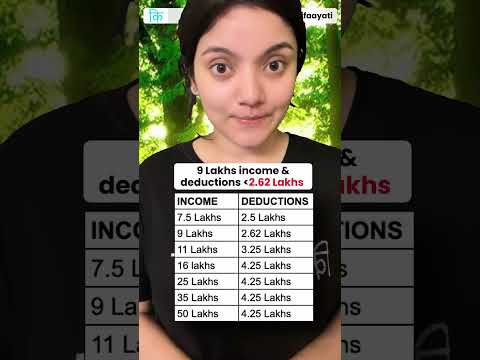

New Income Tax regime vs old regime: Which is more beneficial? | Union Budget 2023

Показать описание

Finance Minister Nirmala Sitharaman announced new Income Tax slabs under the 2023 Union Budget. While this will be the default when you file your taxes this year, you can opt-out and choose the old regime. What is the difference between the two, and which is more beneficial? TNM’s Aditi Kumar explains in this video.

#Budget2023 #UnionBudget2023 #NirmalaSitharaman #budget

–––––––––––––––––––––––––

#Budget2023 #UnionBudget2023 #NirmalaSitharaman #budget

–––––––––––––––––––––––––

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Comparison of Old Tax Regime v/s New Tax regime

New Tax Regime vs Old Tax Regime SIMPLIFIED

Live comparison: Old vs New Tax regime

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

Understanding BIR Tax Deductions

New Tax Regime vs old Tax Regime - Budget 2023 | How to choose | with Excel Calculator - AY 24-25

Reality of the New Income Tax Regime | Old is Gold? | Akash Banerjee & Manjul

Old vs new tax regime: Which one should YOU choose? | Old vs new tax regime 2023

Old vs New Income Tax Malayalam -CA Subin VR

Zero tax on 7 lacs ! Really ? How ?

Tax planning for Individuals | Only 1 week left for March end | CA Rachana Ranade

NEW TAX SLAB|AY 2024-25|NEW TAX REGIME|MALAYALAM|

New or Old 💸 #epmshorts

INCOME TAX NEW SLAB # F.YR 2023-24 # Rs.7,00,000/-= Tax ZERO # NEW TAX REGIME 115BAC OLD TAX REGIME

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator] | Income Tax

Tax Calculation 2023-24. #shorts #tax #govtemployees #calculation #oldvsnew

How much Tax should u pay as per New Regime?

How Rich Pay 0 Tax after Earning Billions

Zero Tax on ₹10 Lakh income #LLAShorts 238

Section 80CCD(2) - Employer's Contribution to NPS | NPS in New Tax Regime | NPS Deduction Incom...

Zero Tax on ₹10,00,000 😍

New income tax slabs vs old

Old Tax vs New Tax Regime | Which Is More Beneficial After Budget 2023?

Комментарии

0:13:35

0:13:35

0:00:20

0:00:20

0:00:47

0:00:47

0:00:37

0:00:37

0:16:59

0:16:59

0:00:25

0:00:25

0:19:01

0:19:01

0:15:34

0:15:34

0:13:30

0:13:30

0:13:13

0:13:13

0:01:00

0:01:00

0:14:17

0:14:17

0:08:44

0:08:44

0:01:01

0:01:01

0:10:40

0:10:40

0:08:34

0:08:34

0:00:27

0:00:27

0:00:45

0:00:45

0:00:59

0:00:59

0:00:59

0:00:59

0:03:07

0:03:07

0:01:00

0:01:00

0:12:11

0:12:11

0:06:41

0:06:41