filmov

tv

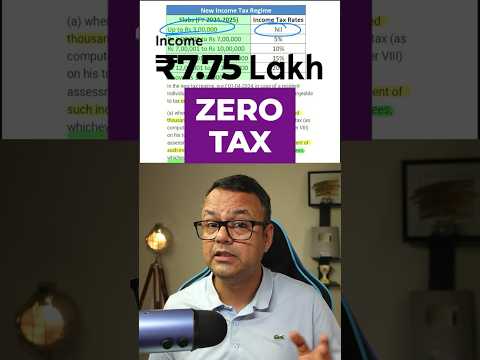

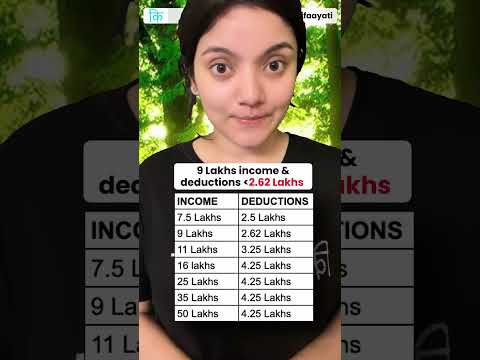

INCOME TAX NEW SLAB # F.YR 2023-24 # Rs.7,00,000/-= Tax ZERO # NEW TAX REGIME 115BAC OLD TAX REGIME

Показать описание

NCOME TAX NEW SLAB # F.YR 2023-24 # Rs.7,00,000/-= Tax ZERO # NEW TAX REGIME Vs OLD TAX REGIME #

INCOME TAX SLAB FOR F.YR 2023-24 # ASS.YR 2024-25 # MALAYALAM VIDEO CLASS # OLD REGIME # NEW REGIME # SEC.115 BAC # INCOME TAX REBATE U/S.87A # CHANGES IN INCOME TAX SLAB # NEW INCOME TAX SLAB # BUDGET 2023 # STANDARD DEDUCTION # INDIVIDUAL INCOME TAX SLAB # INCOME TAX CALCULATOR # SUNIL KUMAR PATTUVAKKARAN # SMART FINANCE MANAGER # KANNUR # MALAYALAM CLASS #

In this video, I am explaining about the CHANGES IN NEW TAX REGIME SEC.115 BAC FOR F.YR 2023-24

Disclaimer: The views presented in this video are in personal and not as a Professional advice. These are only for informational purpose. Users of this information are expected to refer to the relevant existing provisions of the applicable laws. All information in this video Kindly clarify with your Chartered Accountant. •Neither the presenter nor its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this video nor for any actions taken in reliance thereon.

INCOME TAX SLAB FOR F.YR 2023-24 # ASS.YR 2024-25 # MALAYALAM VIDEO CLASS # OLD REGIME # NEW REGIME # SEC.115 BAC # INCOME TAX REBATE U/S.87A # CHANGES IN INCOME TAX SLAB # NEW INCOME TAX SLAB # BUDGET 2023 # STANDARD DEDUCTION # INDIVIDUAL INCOME TAX SLAB # INCOME TAX CALCULATOR # SUNIL KUMAR PATTUVAKKARAN # SMART FINANCE MANAGER # KANNUR # MALAYALAM CLASS #

In this video, I am explaining about the CHANGES IN NEW TAX REGIME SEC.115 BAC FOR F.YR 2023-24

Disclaimer: The views presented in this video are in personal and not as a Professional advice. These are only for informational purpose. Users of this information are expected to refer to the relevant existing provisions of the applicable laws. All information in this video Kindly clarify with your Chartered Accountant. •Neither the presenter nor its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this video nor for any actions taken in reliance thereon.

Комментарии

0:11:02

0:11:02

0:08:44

0:08:44

0:13:35

0:13:35

0:00:17

0:00:17

0:00:06

0:00:06

0:02:29

0:02:29

0:07:39

0:07:39

2:30:13

2:30:13

0:01:00

0:01:00

0:00:59

0:00:59

0:13:13

0:13:13

0:01:00

0:01:00

0:10:48

0:10:48

0:00:42

0:00:42

0:00:29

0:00:29

0:05:34

0:05:34

0:00:51

0:00:51

0:00:52

0:00:52

0:00:20

0:00:20

0:00:47

0:00:47

0:00:05

0:00:05

0:02:58

0:02:58

0:00:10

0:00:10

0:00:11

0:00:11