filmov

tv

The Sharpe Ratio

Показать описание

This video shows how to calculate the Sharpe Ratio.

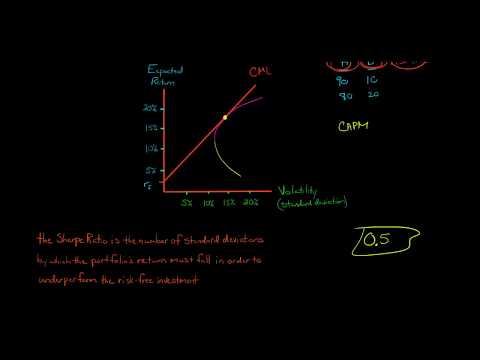

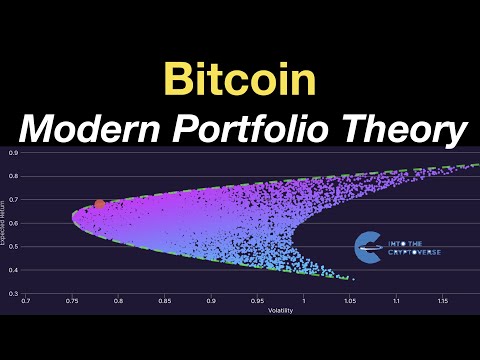

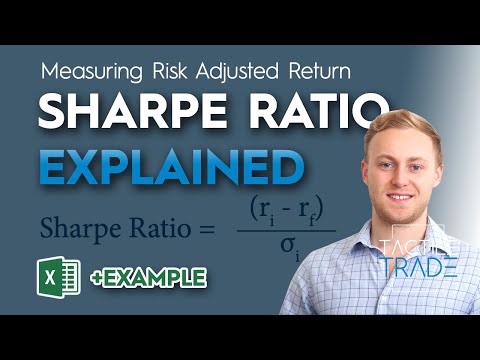

The Sharpe Ratio measures the reward (excess return) to risk (volatility) of a portfolio. This allows investors to rank portfolios. The Sharpe Ratio is calculated as follows:

Sharpe Ratio = Excess Return of Portfolio / Volatility of Portfolio

The excess return of a portfolio is the expected return of a portfolio minus the risk-free rate.

The Sharpe Ratio is also the number of standard deviations by which the portfolio's return must fall to underperform the risk-free investment.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

The Sharpe Ratio measures the reward (excess return) to risk (volatility) of a portfolio. This allows investors to rank portfolios. The Sharpe Ratio is calculated as follows:

Sharpe Ratio = Excess Return of Portfolio / Volatility of Portfolio

The excess return of a portfolio is the expected return of a portfolio minus the risk-free rate.

The Sharpe Ratio is also the number of standard deviations by which the portfolio's return must fall to underperform the risk-free investment.—

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

—

SUPPORT EDSPIRA ON PATREON

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

—

LISTEN TO THE SCHEME PODCAST

—

GET TAX TIPS ON TIKTOK

—

ACCESS INDEX OF VIDEOS

—

CONNECT WITH EDSPIRA

—

CONNECT WITH MICHAEL

—

ABOUT EDSPIRA AND ITS CREATOR

Комментарии

0:05:47

0:05:47

0:03:42

0:03:42

0:02:56

0:02:56

0:01:17

0:01:17

0:02:58

0:02:58

0:01:46

0:01:46

0:02:06

0:02:06

0:05:56

0:05:56

0:04:00

0:04:00

0:06:31

0:06:31

0:04:50

0:04:50

0:03:33

0:03:33

0:03:46

0:03:46

0:19:48

0:19:48

0:03:53

0:03:53

0:07:43

0:07:43

0:15:50

0:15:50

0:24:05

0:24:05

0:15:13

0:15:13

0:03:03

0:03:03

0:02:00

0:02:00

0:03:59

0:03:59

0:20:36

0:20:36

0:15:16

0:15:16