filmov

tv

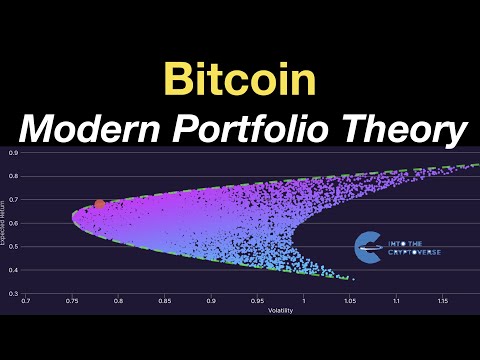

Bitcoin: Modern Portfolio Theory and the Sharpe Ratio

Показать описание

Modern Portfolio Theory was developed decades ago, and in this video, we introduce it as we begin a new video series. In this video, we show the Sharpe ratio for Bitcoin, and compare it to the S&P 500 and Ethereum. During the course of this year, we will investigate various cryptocurrency sectors and weighting techniques to identify "The Efficient Frontier," or the manner in which you can maximize your expected return at a certain risk level, by changing the weights on your portfolio.

If you want exclusive access to all of the premium content, including regression analysis, risk analysis (different from the risk associated with the Sharpe ratio), a weekly report with quantitative analysis, and a weekly premium video, then join the Premium List!

Alternative Option:

If you want exclusive access to all of the premium content, including regression analysis, risk analysis (different from the risk associated with the Sharpe ratio), a weekly report with quantitative analysis, and a weekly premium video, then join the Premium List!

Alternative Option:

Bitcoin: Modern Portfolio Theory and The Sharpe Ratio

Bitcoin: Modern Portfolio Theory and the Sharpe Ratio

Bitcoin & Ethereum: Modern Portfolio Theory

Cryptocurrency Portfolio Construction

Investing $1000 In Crypto? Modern Portfolio Theory

Modern Portfolio Theory Explained!

Chainlink: Price, Logarithmic Regression, Modern Portfolio Theory, and the Sharpe Ratio

Weighting your Cryptocurrency Portfolio

Markowitz Model and Modern Portfolio Theory - Explained

The FUTURE of Bitcoin *invest now*

Coin Bureau CRYPTO Portfolio: Ultimate Investing Strategy!

What Bitcoin Miners Can Learn from Portfolio Management | AIM Summit London 2023

Crypto portfolio simulation using risk-adjusted returns (Modern Portfolio Theory)! #bitcoin #crypto

Bitcoin and Ethereum: The perfect portfolio balance

The Truth Behind Michael Saylor's Controversial All-In Bitcoin vs Portfolio Theory Critique

Lesson 1/9: How to apply Modern Portfolio Theory to Digital Assets / Crypto [Free Course]

Bitcoin vs. Altcoins

How to build a successful crypto portfolio in 2022 | Interview with Scott Melker

HOW MUCH BITCOIN COULD BE SAFELY USED IN A PORTFOLIO?

How Modern Portfolio Theory Can Predict Your Financial Future

Why you should add a volatile asset, like Bitcoin, to improve your portfolio

Crypto's misuse of Modern Portfolio Theory (Part II): our solution

Kevin O'Leary's #cryptocurrency portfolio just got leaked! #shorts

Bitcoin and Beyond: A Guide to Building a Modern Investment Portfolio

Комментарии

0:05:56

0:05:56

0:20:36

0:20:36

0:18:53

0:18:53

0:16:21

0:16:21

0:16:29

0:16:29

0:16:31

0:16:31

0:13:33

0:13:33

0:09:06

0:09:06

0:09:12

0:09:12

0:00:32

0:00:32

0:21:09

0:21:09

0:23:10

0:23:10

0:00:14

0:00:14

0:22:11

0:22:11

0:20:44

0:20:44

0:02:50

0:02:50

0:00:29

0:00:29

0:16:20

0:16:20

0:00:55

0:00:55

0:00:51

0:00:51

0:00:53

0:00:53

0:17:14

0:17:14

0:00:51

0:00:51

0:23:36

0:23:36