filmov

tv

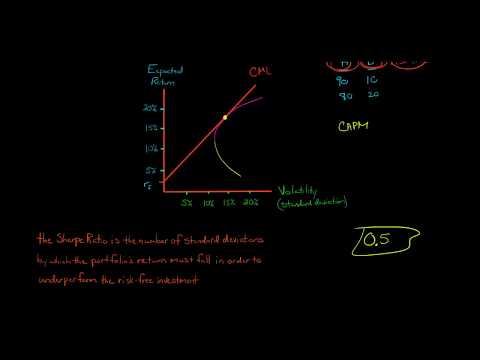

What is The Sharpe Ratio?

Показать описание

Welcome to the Investors Trading Academy talking glossary of financial terms and events.

Our word of the day is “The Sharpe Ratio”

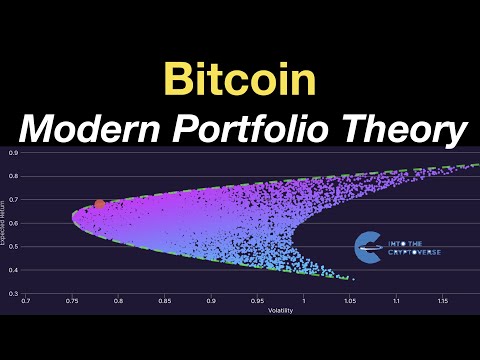

The relationship between risk and return is an essential concept in finance, which argues that riskier investments should compensate investors with higher returns and safer investments should not experience exorbitant price fluctuations.

When comparing the performance of two securities, funds or portfolios, investors must consider risk-adjusted returns to see if they are being adequately compensated for the risk they are assuming. The goal is to achieve the largest return per unit of risk. For example, a mid-cap growth fund may have a Sharpe ratio of 0.40. Meanwhile, the average Sharpe ratio for all mid-cap growth funds is 0.29. This means that this individual fund currently has had better risk-adjusted performance than the average mid-cap growth fund.

William Sharpe devised the Sharpe ratio in 1966 to measure this risk/return relationship, and it has been one of the most-used investment ratios ever since. Here, we discuss how to calculate and interpret the Sharpe ratio.

By Barry Norman, Investors Trading Academy

Our word of the day is “The Sharpe Ratio”

The relationship between risk and return is an essential concept in finance, which argues that riskier investments should compensate investors with higher returns and safer investments should not experience exorbitant price fluctuations.

When comparing the performance of two securities, funds or portfolios, investors must consider risk-adjusted returns to see if they are being adequately compensated for the risk they are assuming. The goal is to achieve the largest return per unit of risk. For example, a mid-cap growth fund may have a Sharpe ratio of 0.40. Meanwhile, the average Sharpe ratio for all mid-cap growth funds is 0.29. This means that this individual fund currently has had better risk-adjusted performance than the average mid-cap growth fund.

William Sharpe devised the Sharpe ratio in 1966 to measure this risk/return relationship, and it has been one of the most-used investment ratios ever since. Here, we discuss how to calculate and interpret the Sharpe ratio.

By Barry Norman, Investors Trading Academy

0:05:47

0:05:47

0:03:42

0:03:42

0:15:50

0:15:50

0:01:17

0:01:17

0:02:58

0:02:58

0:02:06

0:02:06

0:04:50

0:04:50

0:04:00

0:04:00

0:40:41

0:40:41

0:03:46

0:03:46

0:02:18

0:02:18

0:00:24

0:00:24

0:05:56

0:05:56

0:01:46

0:01:46

0:06:13

0:06:13

0:00:49

0:00:49

0:02:00

0:02:00

0:00:57

0:00:57

0:15:16

0:15:16

0:05:10

0:05:10

0:24:05

0:24:05

0:03:59

0:03:59

0:02:27

0:02:27

0:02:27

0:02:27