filmov

tv

Covid-19: why the economy could fare worse than you think

Показать описание

Further reading:

How could COVID-19 affect the US economy?

How covid-19 could change the financial world order

Economy could take 10 years to catch up after Covid-19: CBO

Covid-19: why the economy could fare worse than you think

Why COVID-19 could be the 'last straw' for Lebanon's fragile economy

How Coronavirus could transform the economy for good

How coronavirus exposed the US economy's weaknesses l GMA Digital

Covid-19: how bad will it be for the economy?

How COVID-19 is impacting the economy

Can the economy recover from coronavirus? | Inside Story

Joseph Vavra: Could the COVID-19 crisis permanently affect the US economy?

ECONOMY AFTER COVID-19 | Will Covid-19 cause an economic CRISIS? [2021]

Covid-19: what will happen to the global economy?

COVID-19 and the Economy: What Can We Expect?

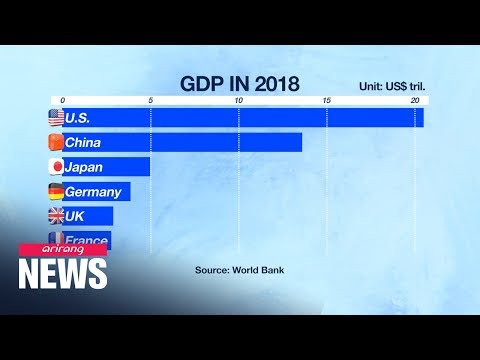

How Can the Coronavirus Impact China’s Economy?

The Covid Economy: The Essential Workforce - BBC Newsnight

Covid-19 cripples US economy in 2020

How could COVID-19 impact Ontario's economy? | Power & Politics

Here's What Will Happen To The Economy During COVID-19

Coronavirus and the economy: Can the world cope with more debt? | Counting the Cost

Will coronavirus outbreak paralyze global economy?

After two years of COVID-19 pandemic, has U.S. economy recovered?

Examining COVID-19's Impact On The U.K. Economy | NBC News NOW

China's economy had severe problems even before Covid-19: Analyst

Комментарии

0:01:55

0:01:55

0:09:58

0:09:58

0:01:55

0:01:55

0:08:47

0:08:47

0:05:38

0:05:38

0:02:38

0:02:38

0:04:31

0:04:31

0:06:33

0:06:33

0:03:35

0:03:35

0:24:51

0:24:51

0:03:33

0:03:33

0:09:22

0:09:22

0:10:06

0:10:06

0:14:54

0:14:54

0:09:46

0:09:46

0:10:29

0:10:29

0:03:01

0:03:01

0:09:38

0:09:38

0:09:54

0:09:54

0:26:01

0:26:01

0:03:03

0:03:03

0:04:08

0:04:08

0:03:37

0:03:37

0:02:51

0:02:51