filmov

tv

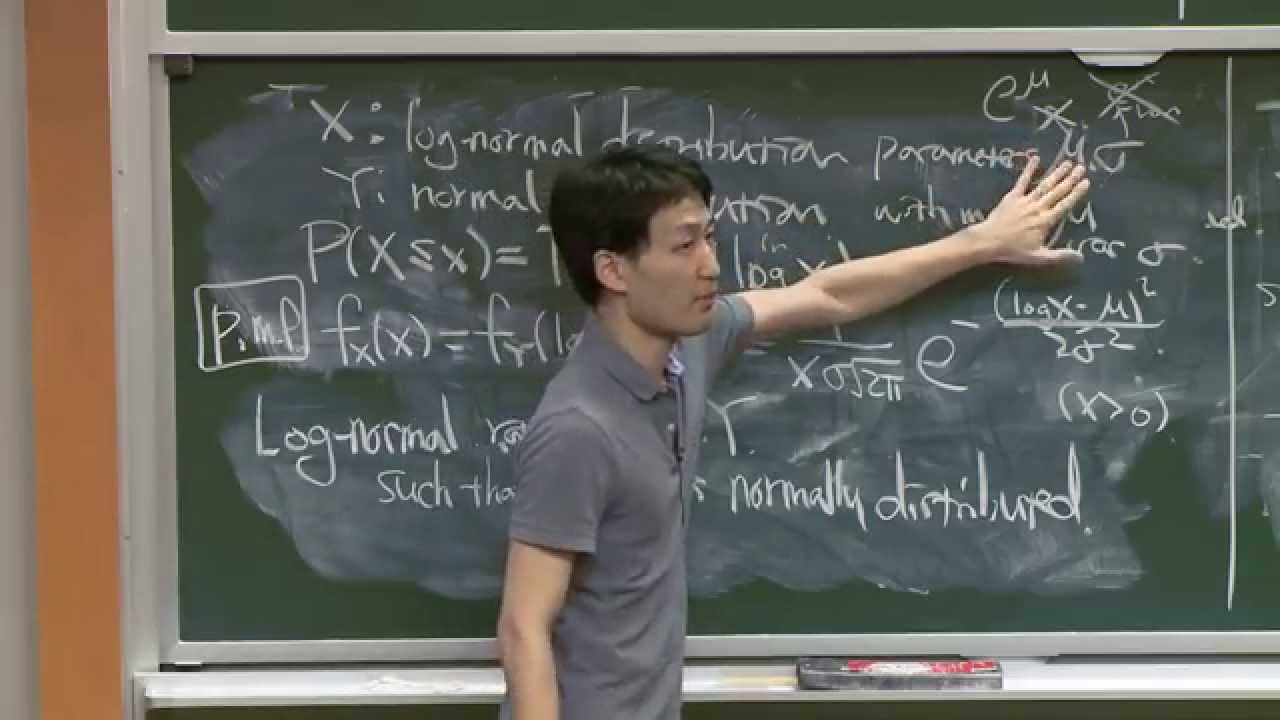

3. Probability Theory

Показать описание

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

Instructor: Choongbum Lee

This lecture is a review of the probability theory needed for the course, including random variables, probability distributions, and the Central Limit Theorem.

*NOTE: Lecture 4 was not recorded.

License: Creative Commons BY-NC-SA

Instructor: Choongbum Lee

This lecture is a review of the probability theory needed for the course, including random variables, probability distributions, and the Central Limit Theorem.

*NOTE: Lecture 4 was not recorded.

License: Creative Commons BY-NC-SA

3. Probability Theory

Probability Theory 3 | Discrete vs. Continuous Case

Introduction to Probability, Basic Overview - Sample Space, & Tree Diagrams

Math Antics - Basic Probability

Why “probability of 0” does not mean “impossible” | Probabilities of probabilities, part 2

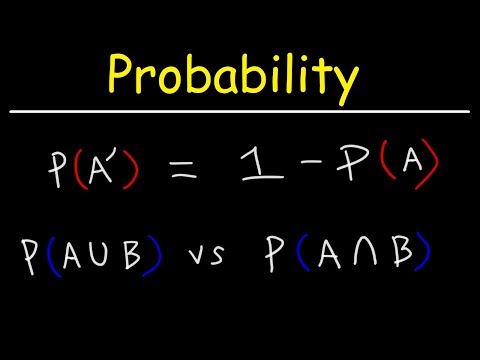

Multiplication & Addition Rule - Probability - Mutually Exclusive & Independent Events

Probability of Complementary Events & Sample Space

Bayes theorem, the geometry of changing beliefs

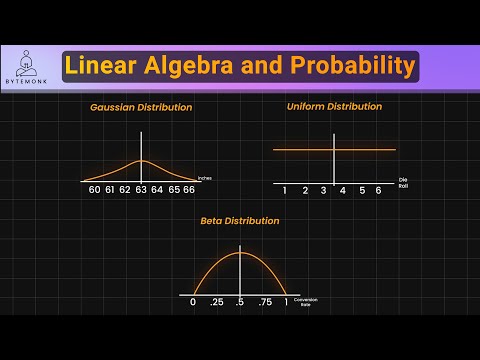

Master Linear Algebra & Probability for Machine Learning

Binomial distributions | Probabilities of probabilities, part 1

Bayes' Theorem EXPLAINED with Examples

But what is the Central Limit Theorem?

Probability Theory 3 | Discrete vs. Continuous Case [dark version]

3 game theory tactics, explained

Probability

Probability explained | Independent and dependent events | Probability and Statistics | Khan Academy

Types of Probability - Classical, Empirical, Subjective - Prob / Stat

Probability - Drawing Venn Diagrams

Experimental vs Theoretical Probability

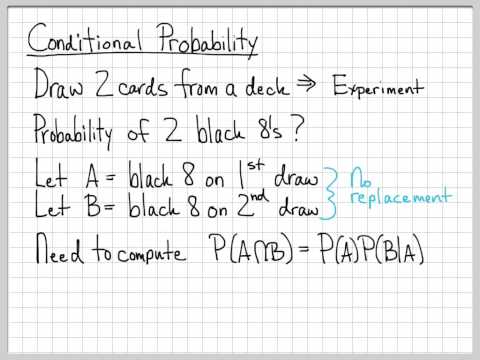

Fundamentals of Probability Theory (3/12): Conditional Probability Example

The Monty Hall Problem - Explained

Probability of Dice

3.1.3 Three Types of Probability (Classical-Theoretical, Empirical-Statistical & Subjective)

Basic Probability Part 1 Important Question Solution MBS, MBA, MPA, BBS, BBA Statistics Solution

Комментарии

1:18:25

1:18:25

0:11:27

0:11:27

0:16:59

0:16:59

0:11:28

0:11:28

0:10:01

0:10:01

0:10:02

0:10:02

0:05:48

0:05:48

0:15:11

0:15:11

0:13:37

0:13:37

0:12:34

0:12:34

0:08:03

0:08:03

0:31:15

0:31:15

0:11:12

0:11:12

0:07:11

0:07:11

0:19:01

0:19:01

0:08:18

0:08:18

0:08:10

0:08:10

0:06:13

0:06:13

0:04:26

0:04:26

0:03:13

0:03:13

0:02:48

0:02:48

0:02:44

0:02:44

0:18:26

0:18:26

0:11:21

0:11:21