filmov

tv

Deriving the Intertemporal Budget Constraint (Detailed)

Показать описание

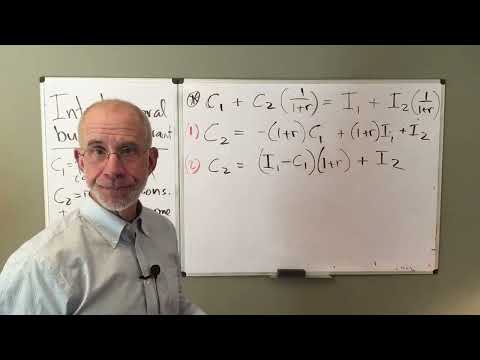

I derive the intertemporal budget constraint for a two-period model of intertemporal choice. In a later video, I shall derive this for more periods. Check out the playlist for intertemporal macroeconomics as a whole, linked at the end of this video.

We discuss the assumptions of the two-period model of intertemporal choice. This involves consumers living for 2 periods. They can consume, save or borrow in these time periods, allowing for consumption that differs from their income in that period. In order to defer income to other periods, they can buy or sell one-period bonds with interest r.

We can then mathematically write the budget constraint for each of these periods. With a bit of substitution and rearranging, this gives us the intertemporal budget constraint. This says that the present value of consumption is equal to the present value of income. The consumer can thus not spend more than she earns, but will spend all of her income since more consumption is always assumed to increase her utility.

This is a general solution so that this can be solved algebraically. This is intended to give an intuitive explanation of how to find the intertemporal budget constraint for two periods. This equation also should give some understanding with regards to the concepts of time preference and present value. Let me know if you have any questions, and I can look to offer some examples in the future.

That is all for deriving the intertemporal budget constraint. Hopefully, this was a sufficiently detailed explanation!

In future videos we shall look at borrowers and savers in more detail, examining what happens with a change in the interest rate, changes in income and other exogenous changes.

Subscribe for more videos looking at games of chance, tutorials, and everything to do with the industry. Put suggestions for video ideas in the comments section below and any feedback offered would be greatly appreciated.

We discuss the assumptions of the two-period model of intertemporal choice. This involves consumers living for 2 periods. They can consume, save or borrow in these time periods, allowing for consumption that differs from their income in that period. In order to defer income to other periods, they can buy or sell one-period bonds with interest r.

We can then mathematically write the budget constraint for each of these periods. With a bit of substitution and rearranging, this gives us the intertemporal budget constraint. This says that the present value of consumption is equal to the present value of income. The consumer can thus not spend more than she earns, but will spend all of her income since more consumption is always assumed to increase her utility.

This is a general solution so that this can be solved algebraically. This is intended to give an intuitive explanation of how to find the intertemporal budget constraint for two periods. This equation also should give some understanding with regards to the concepts of time preference and present value. Let me know if you have any questions, and I can look to offer some examples in the future.

That is all for deriving the intertemporal budget constraint. Hopefully, this was a sufficiently detailed explanation!

In future videos we shall look at borrowers and savers in more detail, examining what happens with a change in the interest rate, changes in income and other exogenous changes.

Subscribe for more videos looking at games of chance, tutorials, and everything to do with the industry. Put suggestions for video ideas in the comments section below and any feedback offered would be greatly appreciated.

Комментарии

0:06:56

0:06:56

0:12:13

0:12:13

0:08:44

0:08:44

0:26:26

0:26:26

0:10:41

0:10:41

0:12:08

0:12:08

0:16:23

0:16:23

0:24:44

0:24:44

8:12:09

8:12:09

0:05:02

0:05:02

0:06:46

0:06:46

0:04:59

0:04:59

0:15:33

0:15:33

0:12:39

0:12:39

0:06:46

0:06:46

0:02:20

0:02:20

0:08:27

0:08:27

0:11:13

0:11:13

0:23:24

0:23:24

0:16:06

0:16:06

0:13:40

0:13:40

0:04:31

0:04:31

0:08:36

0:08:36

0:22:07

0:22:07