filmov

tv

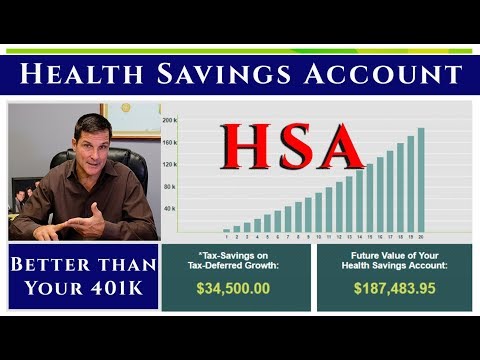

Why HSA is better than a 401K Explained by a CFP®

Показать описание

5 GREAT REASONS TO LOVE HSA'S!

2022 contributions -$3,650/individual , $7,300 Couple and $1,000 catch up if over age 55

Qualifying High Deductible Health Plan (HDHP) annual out-of-pocket cannot exceed $6,900 for self coverage and $13,800 for family.

Link to Deeper Dive into HSA video -

How much can you contribute?

Who Can Use HSA’s?

What about the burden of having a high medical insurance deductible?

How does the money grow in a Health Saving Account?

2022 contributions -$3,650/individual , $7,300 Couple and $1,000 catch up if over age 55

Qualifying High Deductible Health Plan (HDHP) annual out-of-pocket cannot exceed $6,900 for self coverage and $13,800 for family.

Link to Deeper Dive into HSA video -

How much can you contribute?

Who Can Use HSA’s?

What about the burden of having a high medical insurance deductible?

How does the money grow in a Health Saving Account?

The Real TRUTH About An HSA - Health Savings Account Insane Benefits

Why HSA is better than a 401K Explained by a CFP®

Why Should I Use a Health Savings Account (HSA)?

Why HSA is better than a 401K?

Which Healthcare Account Will Save You More Money? HSA vs HRA vs FSA

Why Your HDHP & HSA Are Better Than You Think

An HSA is better than an FSA

Why HSA Might Be Better Than a 401(k) | Triple Tax Advantage Explained!

Maximize Your HSA Benefits Before Retirement!

Should You Prioritize a Roth IRA or an HSA? (Here is the Answer)

This is Why HSAs are Way Better Than FSAs

What Is an HSA and Why Does Clark Howard Love It?

Why an HSA is a Retirement Game Changer

HSA Triple Tax Loophole | 17.65% Better Than 401K

Top 4 HSA Providers RANKED (HealthEquity, Optum, Fidelity, HSA Bank)

Are Health Savings Accounts (HSA) better than traditional insurance?

3 Ways the HSA Is Better Than the Roth IRA

What is an HSA? Most people use their HSA just for co-pays.

Understanding the Investing Sequence - 401(K), HSA, & Roth IRA

Roth IRA vs. Health Savings Account (HSA): Which Is Better?

HSA - The Ultimate Investment Account | Never Pay Taxes!

Is a Health Savings Account (HSA) better than a 401(k)?

What is a health savings account, and is it a good idea?

Company's HSA Plan is More Expensive Than Non-HSA Plans!

Комментарии

0:20:09

0:20:09

0:06:28

0:06:28

0:04:54

0:04:54

0:09:21

0:09:21

0:11:15

0:11:15

0:06:39

0:06:39

0:01:43

0:01:43

0:08:35

0:08:35

0:00:46

0:00:46

0:05:16

0:05:16

0:06:56

0:06:56

0:05:27

0:05:27

0:00:56

0:00:56

0:06:15

0:06:15

0:04:10

0:04:10

0:01:20

0:01:20

0:09:57

0:09:57

0:00:36

0:00:36

0:08:07

0:08:07

0:19:49

0:19:49

0:07:23

0:07:23

0:03:37

0:03:37

0:01:34

0:01:34

0:04:50

0:04:50