filmov

tv

Understanding the Investing Sequence - 401(K), HSA, & Roth IRA

Показать описание

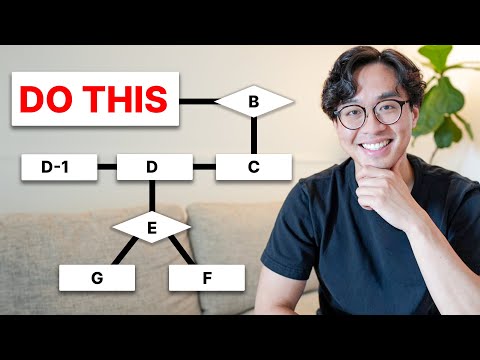

Investing can seem like a puzzle, but with the right strategy, you can make the most of your money! In this video, we'll be discussing the "investing sequence" to help you understand where to throw your money first. We'll start with the 401(k) and why it's important to invest enough to claim the full match if your employer offers one. Then, we'll talk about the pros and cons of investing in a 401(k) and why it might not be the best option for everyone. Next up, we'll dive into the world of HSAs - a unique savings option with TRIPLE tax benefits. And lastly, we'll introduce you to the Roth IRA - the perfect solution for anyone looking to avoid taxes on their retirement savings. Watch now to learn the why behind the where of investing!

Understanding the Investing Sequence - 401(K), HSA, & Roth IRA

Investing 101 - Sequence of Return Risk Explained

ACCOUNTANT EXPLAINS: The Optimal Order of Investing Your Money

Optimal Order For Investing Your Money

Stock Market Order Types (Market Order, Limit Order, Stop Loss, Stop Limit)

FINANCIAL PLANNER EXPLAINS: Optimal Order of Investing for Retirement

The Optimal Order For Investing Your Money (2024)

The Optimal Order For Investing Your Money

Efrat Fenigson - Bitcoin? Understand Money First

Ideal Order Of Investing For High Income Earners

What Does The Bid & Ask Mean? (Investing In The Stock Market)

Market Order vs Limit Order EXPLAINED (investing for beginners)

The Optimal Order For Investing Your Money In 2024

Jack Bogle: How to Deal with Sequence of Return Risk in Investments

Optimal Order for Investing Your Money | Step-by-Step

Optimal order of investing- where to start and what to do next?

How To Know When To Buy And Sell Stocks #shorts

Financial Advisor Explains: The Best Investing Sequence🤔💡

Trailing Stop Order Stock Trading #stockmarket #stocks #finance #investing #money #shorts

Optimal Order of Investing: Your Financial Roadmap

Best Sequence of Investments for Wealth Building

What is a order book in crypto? #crypto #trading #investing

Optimal Order for Investing Your Money in 2024

Sequence of returns risk explained / Investing insights

Комментарии

0:08:07

0:08:07

0:10:14

0:10:14

0:09:16

0:09:16

0:10:26

0:10:26

0:09:05

0:09:05

0:13:21

0:13:21

0:15:03

0:15:03

0:17:00

0:17:00

0:00:26

0:00:26

0:12:18

0:12:18

0:03:52

0:03:52

0:04:57

0:04:57

0:15:47

0:15:47

0:04:16

0:04:16

0:18:53

0:18:53

0:21:48

0:21:48

0:01:00

0:01:00

0:00:42

0:00:42

0:00:54

0:00:54

0:18:09

0:18:09

0:09:28

0:09:28

0:00:51

0:00:51

0:18:13

0:18:13

0:05:53

0:05:53