filmov

tv

What is the Most Strategic Way to Utilize Your HSA?

Показать описание

What is the Most Strategic Way to Utilize Your HSA?

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

Simon Sinek on How to Improve Strategic Thinking

5 Mental Models to Think Like a Strategic Genius

How to be a more strategic thinker

Tactical vs Strategic Victory

What is the Most Strategic Way to Utilize Your HSA?

Want To Become A More Strategic Thinker? Do This...

Ex-NATO Commander explains what Israel’s most strategic next move is

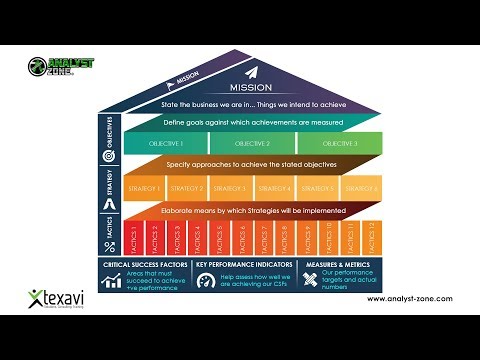

MOST-Mission Objectives Strategy Tactics - Strategic Analysis Technique

Transforming Strategy Into Action for Africa’s Future | Insights from Chilipi Mogasha

What is Strategic Thinking? The Deep Dive Strategic Thinking Framework

Use Strategic Thinking to Create the Life You Want

Best Books on Strategic Thinking - How to be the Greatest Strategist

How to be a more strategic thinker

It's Not Manipulation, It's Strategic Communication | Keisha Brewer | TEDxGeorgetown

Art of War & Strategic Thinking for Entrepreneurs in 2020

Strategic Planning Basics

With New F-35s, Remote Alaska Base Protects Most ‘Strategic Place in the World’

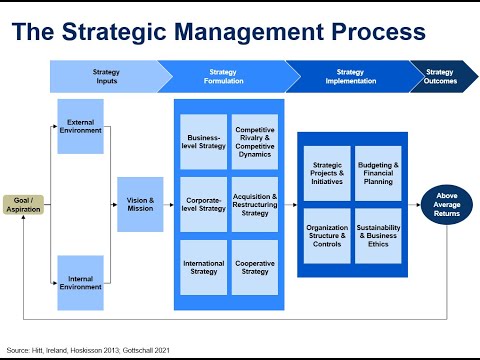

Business Strategy 01 - Introduction to Strategic Management

The single biggest reason why start-ups succeed | Bill Gross | TED

Strategic calorie and protein intake matters most

What Putin fears most? Thomas L. Friedman explains the limited strategic choices left for Putin

Strategic QE: Money Creation for Sustainable Investment (Richard Werner)

6 Country Have The Best Strategic Position

4 Obstacles to Becoming More Strategic

Комментарии

0:01:51

0:01:51

0:16:00

0:16:00

0:09:07

0:09:07

0:02:04

0:02:04

0:06:20

0:06:20

0:03:32

0:03:32

0:08:26

0:08:26

0:02:47

0:02:47

1:36:10

1:36:10

0:08:18

0:08:18

0:10:22

0:10:22

0:03:06

0:03:06

0:08:04

0:08:04

0:10:57

0:10:57

0:21:41

0:21:41

0:22:16

0:22:16

0:02:16

0:02:16

0:17:43

0:17:43

0:06:41

0:06:41

0:00:57

0:00:57

0:00:27

0:00:27

0:10:37

0:10:37

0:05:27

0:05:27

0:04:53

0:04:53