filmov

tv

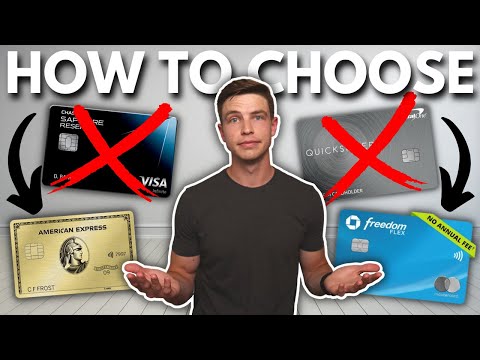

My All-Time FAVORITE Credit Cards

Показать описание

These are my Top 5 All Time Favorite Credit Cards and why I got them - enjoy! Add me on Instagram: GPStephan - Click “Show More” to see ad disclosure

The YouTube Creator Academy:

My ENTIRE Camera and Recording Equipment:

First: The American Express Gold

I got this card because it’s known as what’s called a “Charge Card,” meaning it’s not a card that you’re meant to carry a balance on…Because of that, and because this is a “Charge card,” it technically doesn’t have a pre-set spending limit, meaning it won’t negatively impact your credit utilization when the credit bureaus calculate your credit score.

You can also get 40,000-50,000 points just for signing up - which, on Aeroplan, is worth about 2 round trip plane tickets in North America. In addition to that, there’s some other advantages that make the card a good deal…for instance, you’ll get $100 per year as an airline credit if you chose to check your bags or purchase in flight meals. You’ll also get purchase protection up to $10,000 per purchase…so if your item is lost, stolen, or damaged in the first few months, they’ll take care of it for you. They’ll also extend your warranty for up to 2 years on eligible products…so if you buy something and it breaks, chances are, American Express would cover it.

Second: The American Express Platinum.

When I signed up this card, I got 60,000 points. In addition to that, it gets you into one of my favorite places in the entire world: American Express Centurion Lounge. In addition to that, you’ll also get a $100 Hotel Credit on select hotels…discounts on other hotel services…a $200 airline credit towards the airline of your choice…and then you’ll get top of the line purchase and loss protection.

Now, yes…this card does come with a $550 per year annual fee. And to be eligible to even get the card, you’ll typically need a strong credit score, combined with a decent income…but provided you’ll actually USE these benefits, it could EASILY pay for the annual fee so many times over.

Third: The Chase Sapphire Reserve

Now they’ll give you 50,000 points for signing up when you spend $4000 in the first 3 months. And when you redeem those points through chase, they’re worth 50% more…meaning 50,000 points will give you $750 worth of value.

In addition to that, they’ll also give you a $300 annual travel credit. And best part of all, is that with this card, you get access to their Priority Pass Airport Lounge. However, there is an annual fee of $450 per year. BUT, between the $750 worth of the sign up bonus…the $300 airline credit…and the priority pass lounge access, not to mention a TON of other rewards for the card that are just too much to mention…the $450 just pays for itself very quickly.

Fourth: The JP Morgan Reserve Credit Card

Now not always, but USUALLY to get access to the JP Morgan Private Bank, and to get access to this credit card, you need $10 million in assets…hence, the $10 million dollar credit card. And even though, I admit, this card is almost identical to the Chase Sapphire Reserve in terms of benefits…it does have a few unique advantages, like complimentary United Lounge Access.

Fifth: Chase Ink Business Preferred

Typically you can find 80,000-100,000 point sign up offers. The GREAT thing with this card is that there’s only an annual fee of $95 per year…which, in my opinion, is a small price to pay for $1200+ worth of free travel.

Now as far as overall rewards go…it’s decent. Nothing spectacular, although you can get 3x points on spending on social media advertising and other business expenses…which is nice, but not as nice as some of the other cards I’ve mentioned.

The YouTube Creator Academy:

My ENTIRE Camera and Recording Equipment:

First: The American Express Gold

I got this card because it’s known as what’s called a “Charge Card,” meaning it’s not a card that you’re meant to carry a balance on…Because of that, and because this is a “Charge card,” it technically doesn’t have a pre-set spending limit, meaning it won’t negatively impact your credit utilization when the credit bureaus calculate your credit score.

You can also get 40,000-50,000 points just for signing up - which, on Aeroplan, is worth about 2 round trip plane tickets in North America. In addition to that, there’s some other advantages that make the card a good deal…for instance, you’ll get $100 per year as an airline credit if you chose to check your bags or purchase in flight meals. You’ll also get purchase protection up to $10,000 per purchase…so if your item is lost, stolen, or damaged in the first few months, they’ll take care of it for you. They’ll also extend your warranty for up to 2 years on eligible products…so if you buy something and it breaks, chances are, American Express would cover it.

Second: The American Express Platinum.

When I signed up this card, I got 60,000 points. In addition to that, it gets you into one of my favorite places in the entire world: American Express Centurion Lounge. In addition to that, you’ll also get a $100 Hotel Credit on select hotels…discounts on other hotel services…a $200 airline credit towards the airline of your choice…and then you’ll get top of the line purchase and loss protection.

Now, yes…this card does come with a $550 per year annual fee. And to be eligible to even get the card, you’ll typically need a strong credit score, combined with a decent income…but provided you’ll actually USE these benefits, it could EASILY pay for the annual fee so many times over.

Third: The Chase Sapphire Reserve

Now they’ll give you 50,000 points for signing up when you spend $4000 in the first 3 months. And when you redeem those points through chase, they’re worth 50% more…meaning 50,000 points will give you $750 worth of value.

In addition to that, they’ll also give you a $300 annual travel credit. And best part of all, is that with this card, you get access to their Priority Pass Airport Lounge. However, there is an annual fee of $450 per year. BUT, between the $750 worth of the sign up bonus…the $300 airline credit…and the priority pass lounge access, not to mention a TON of other rewards for the card that are just too much to mention…the $450 just pays for itself very quickly.

Fourth: The JP Morgan Reserve Credit Card

Now not always, but USUALLY to get access to the JP Morgan Private Bank, and to get access to this credit card, you need $10 million in assets…hence, the $10 million dollar credit card. And even though, I admit, this card is almost identical to the Chase Sapphire Reserve in terms of benefits…it does have a few unique advantages, like complimentary United Lounge Access.

Fifth: Chase Ink Business Preferred

Typically you can find 80,000-100,000 point sign up offers. The GREAT thing with this card is that there’s only an annual fee of $95 per year…which, in my opinion, is a small price to pay for $1200+ worth of free travel.

Now as far as overall rewards go…it’s decent. Nothing spectacular, although you can get 3x points on spending on social media advertising and other business expenses…which is nice, but not as nice as some of the other cards I’ve mentioned.

Комментарии

0:15:08

0:15:08

0:11:46

0:11:46

0:17:31

0:17:31

0:20:31

0:20:31

0:00:58

0:00:58

0:12:39

0:12:39

0:00:56

0:00:56

0:11:52

0:11:52

0:07:57

0:07:57

0:12:03

0:12:03

0:14:21

0:14:21

0:17:53

0:17:53

0:12:30

0:12:30

0:21:35

0:21:35

0:11:37

0:11:37

0:15:39

0:15:39

0:15:24

0:15:24

0:16:03

0:16:03

0:15:08

0:15:08

0:13:55

0:13:55

0:15:45

0:15:45

0:16:41

0:16:41

0:08:45

0:08:45

0:12:32

0:12:32