filmov

tv

Correlation (Pearson) Explained with Excel Walkthrough

Показать описание

Pearsons Correlation coefficient is a useful concept to understand when seeking to determine whether assets behave jointly. Pearsons correlation coefficient assumes that the joint probability distribution of assets returns follows a bivariate normal distribution (when comparing two assets). Even though this has its pitfalls when it comes to financial time series analysis, it serves as a great way to learn about math notation for mean, variance, covariance and correlation.

This correlation coefficient measure is likely also the most commonly used, albeit the previously mentioned drawbacks.

We will lead on from this video to cover Kendalls Tau, Spearman's Rho, Copula dependency and more...

This correlation coefficient measure is likely also the most commonly used, albeit the previously mentioned drawbacks.

We will lead on from this video to cover Kendalls Tau, Spearman's Rho, Copula dependency and more...

How To Perform A Pearson Correlation Test In Excel

How to Calculate a Correlation in Microsoft Excel - Pearson's r

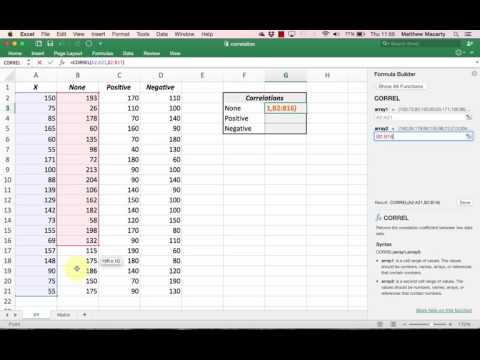

Correlation (Pearson) Explained with Excel Walkthrough

How To Calculate Pearson Correlation Test In Microsoft Excel | Perform Pearson correlation in exce

Introduction to Correlation Analysis in Excel

How to Calculate a Correlation (and P-Value) in Microsoft Excel

Pearson correlation [Simply explained]

How To Create A Correlation Matrix In Excel (With Colors!)

Karl Pearson's Correlation Coefficient - Step by Step Calculation - in Excel

Pearson Correlation r and p Values in Excel

Excel - Pearson correlation coefficient (incl significance test)

Using Excel to calculate a correlation coefficient || interpret relationship between variables

Calculating Correlation Coefficient Excel

How to Calculate a Correlation in Excel - Pearson's r; Linear Relationship

The (Pearson) Correlation Coefficient Explained in One Minute: From Definition to Formula + Examples

How to calculate Pearson correlation coefficient and p-value in excel

Pearson's Correlation, Clearly Explained!!!

Hypothesis Testing correlation (Excel)

Pearson Correlations - Bivariate Statistical Tests in Marketing Research Using Excel

how to compute pearson r for correlation using excel

Calculating Pearson's Correlation Coefficient Using Excel

Karl Pearson's Correlation Coefficient - Formula in Excel

How to calculate Pearson correlation coefficient and p-value in excel

Pearson Correlation Explained (Inc. Test Assumptions)

Комментарии

0:04:31

0:04:31

0:02:14

0:02:14

0:20:57

0:20:57

0:05:17

0:05:17

0:09:52

0:09:52

0:05:16

0:05:16

0:07:50

0:07:50

0:07:33

0:07:33

0:05:09

0:05:09

0:08:13

0:08:13

0:04:32

0:04:32

0:05:22

0:05:22

0:01:56

0:01:56

0:01:58

0:01:58

0:01:29

0:01:29

0:03:00

0:03:00

0:19:13

0:19:13

0:07:37

0:07:37

0:34:06

0:34:06

0:12:31

0:12:31

0:09:46

0:09:46

0:00:39

0:00:39

0:06:30

0:06:30

0:16:36

0:16:36