filmov

tv

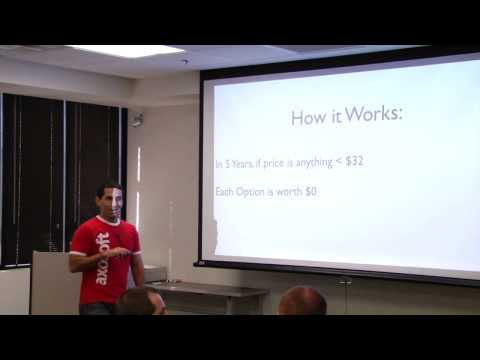

Are Stock Options Worth It?

Показать описание

Equity compensation like stock options used to be reserved only for C-suite executives. But today it seems like most employers are offering them to their workers... but are these "golden handcuffs" worth the tax headache?

Two Cents is hosted by Philip Olson, CFP® and Julia Lorenz-Olson, AFC®

Directors: Katie Graham & Andrew Matthews

Written by: Julia Lorenz-Olson, AFC®

Executive Producer: Amanda Fox

Produced by: Katie Graham

Edited & Animated by: Dano Johnson

Fact checker: Yvonne McGreevy

Executive in Charge for PBS: Maribel Lopez

Director of Programming: Gabrielle Ewing

Assistant Director of Programming for PBS: John Campbell

Images by: Shutterstock

Music by: APM

Two Cents is produced by Spotzen for PBS

Are Stock Options Worth It?

Is Participate In My Employee Stock Option A Bad Idea?

How People Get Rich With Options Trading (Math Shown)

Before You Buy a Stock Option - How They Work and Why They're High Risk

Employee Stock Options Explained | The Terms You Need To Know!

Stock Options Explained

What are Employee stock options (ESO)?

Startup Stock Options Explained - Startups 101

The Problem with startup Stock Options

Is Options Trading GAMBLING?

Options Trading: Understanding Option Prices

Restricted Stock vs. Stock Options (Everything You Need to Know)

Options Trading vs Day Trading (Why I don't trade stocks)

Why Options Are Rarely Exercised (Options Traders MUST Know This)

0DTE: Inside the Explosion of Ultra-Risky Options Trading | WSJ

I Tried Stock Options Trading For a Week

Non-Qualified Stock Options: Basics | Taxes | When Should You Exercise?

Stock Options 💰 Employee stock options explained!

Options Trading MYSTERY: How to Choose Your Strike Price 🔍

The One BIG PROBLEM With Options Trading (Important)

Warren Buffet explains how one could've turned $114 into $400,000 by investing in S&P 500 i...

Understanding ESOP (Employee Stock Option Plans) (Finance Explained)

Employee Stock Options Explained

Stock Options vs RSUs: Two Types Of Company Equity

Комментарии

0:08:36

0:08:36

0:06:15

0:06:15

0:06:59

0:06:59

0:13:33

0:13:33

0:08:10

0:08:10

0:10:16

0:10:16

0:03:33

0:03:33

0:05:44

0:05:44

0:08:47

0:08:47

0:12:42

0:12:42

0:07:31

0:07:31

0:09:29

0:09:29

0:11:10

0:11:10

0:14:13

0:14:13

0:05:16

0:05:16

0:10:05

0:10:05

0:11:09

0:11:09

0:13:52

0:13:52

0:10:55

0:10:55

0:08:54

0:08:54

0:00:50

0:00:50

0:03:14

0:03:14

0:09:29

0:09:29

0:06:18

0:06:18