filmov

tv

Capital Markets Quickly Explained

Показать описание

Must read book: Introduction to Actuaries and Actuarial Science

This video quickly explains capital markets by looking at what they are, what they are made up of, what they form part of, what they can do, what can be done to them, examples of them, their properties and what they are associated with.

I am experimenting with my new study method and this video was built on the framework, so please provide feedback.

This topic is part of the subjects CT2, CA1, ST5 and SA5.

-----------------------------

Let's Keep in Contact

-----------------------------

Hit the subscribe button if you would like to see more on Youtube.

Social Media:

Premium Content on Udemy:

Financial Maths & Theory of Interest

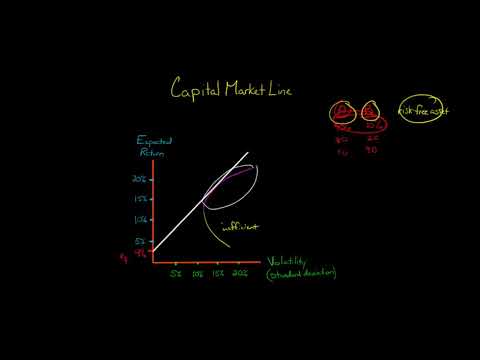

Financial Engineering & Portfolio Theory

Copulas

Credit Risk Models

Market Risk Models

Mathematical Statistics for Actuaries

Bayesian Statistics & Credibility Theory

Economic Capital Management & Models

Stochastic Processes & Markov Chains

Time Series

Loss Distributions

Principles of Actuarial Models

Excel for the CM2-B Exam (Financial Engineering)

How to become an Actuary (FREE)

-----------------------------

This video quickly explains capital markets by looking at what they are, what they are made up of, what they form part of, what they can do, what can be done to them, examples of them, their properties and what they are associated with.

I am experimenting with my new study method and this video was built on the framework, so please provide feedback.

This topic is part of the subjects CT2, CA1, ST5 and SA5.

-----------------------------

Let's Keep in Contact

-----------------------------

Hit the subscribe button if you would like to see more on Youtube.

Social Media:

Premium Content on Udemy:

Financial Maths & Theory of Interest

Financial Engineering & Portfolio Theory

Copulas

Credit Risk Models

Market Risk Models

Mathematical Statistics for Actuaries

Bayesian Statistics & Credibility Theory

Economic Capital Management & Models

Stochastic Processes & Markov Chains

Time Series

Loss Distributions

Principles of Actuarial Models

Excel for the CM2-B Exam (Financial Engineering)

How to become an Actuary (FREE)

-----------------------------

Комментарии

0:05:46

0:05:46

0:06:18

0:06:18

0:10:44

0:10:44

0:03:14

0:03:14

0:14:53

0:14:53

0:05:00

0:05:00

0:04:30

0:04:30

0:17:34

0:17:34

0:00:25

0:00:25

0:14:28

0:14:28

0:03:34

0:03:34

0:08:49

0:08:49

0:05:45

0:05:45

0:07:42

0:07:42

0:03:06

0:03:06

0:13:02

0:13:02

0:05:06

0:05:06

0:05:20

0:05:20

0:03:25

0:03:25

0:03:13

0:03:13

0:08:44

0:08:44

0:03:18

0:03:18

0:01:30

0:01:30

0:05:32

0:05:32