filmov

tv

Efficient Capital Markets Explained

Показать описание

In every one of my videos I tell you things that hinge on one of the landmark ideas in financial economics, the efficiency of the capital markets. As fundamental as market efficiency is to good financial decision-making, it is poorly understood by most investors.

Referenced in this video:

------------------

Follow Ben Felix on

Follow PWL Capital on:

You can find the Rational Reminder podcast on

Google Podcasts:

Apple Podcasts:

Spotify Podcasts:

------------------

Referenced in this video:

------------------

Follow Ben Felix on

Follow PWL Capital on:

You can find the Rational Reminder podcast on

Google Podcasts:

Apple Podcasts:

Spotify Podcasts:

------------------

Efficient Capital Markets Explained

Efficient Market Hypothesis - EMH Explained Simply

Efficient Market Theory (AND WHAT ARE THE 3 DIFFERENT FORMS?)

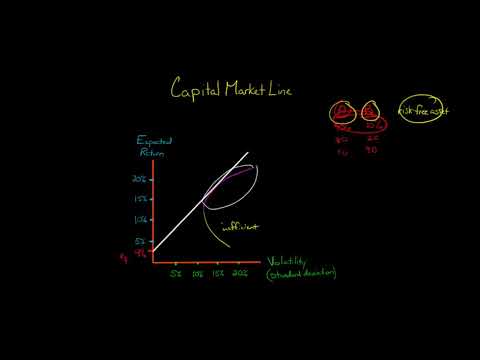

The Capital Market Line

What Is the Efficient Market Hypothesis?

An Introduction to Efficient Capital Markets

7. Efficient Markets

CFA Level I Equity Investments - Efficient Market Hypothesis

Why Market Regimes Matter: The Secret to Market Trends

Is The Market Efficient?

Efficient Markets

What is The Efficient Market Hypothesis - EMH?

Efficient Market Hypothesis【Dr. Deric】

(11 of 12) Ch.12 - Capital market efficiency

Warren Buffett & Charlie Munger: Efficient Market Theory

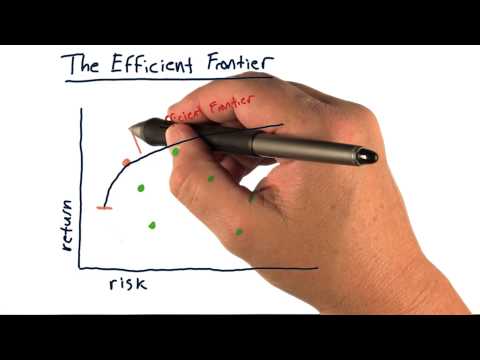

The efficient frontier

Efficient markets

The Efficient Market Hypothesis and Technical Analysis

Efficient Frontier, Sharpe Ratio and Capital Market Line (CML)

What is Efficient Capital Market? Easy Explanation #investingforbeginners

Efficient Capital Markets, Behavioral Finance, and Technical Analysis

Efficient Capital Markets and Behavioral Challenges PPT

Efficient Capital Markets and Behavioural Finance: A Brief Overview

Efficient market hypothesis | Strong semi strong and weak form | Commerce Notes | Finance Beginners

Комментарии

0:14:28

0:14:28

0:09:01

0:09:01

0:05:11

0:05:11

0:05:45

0:05:45

0:02:35

0:02:35

0:18:09

0:18:09

1:07:44

1:07:44

0:03:28

0:03:28

0:18:49

0:18:49

0:07:02

0:07:02

0:15:14

0:15:14

0:01:58

0:01:58

0:07:17

0:07:17

0:16:40

0:16:40

0:04:38

0:04:38

0:02:54

0:02:54

0:13:05

0:13:05

0:01:54

0:01:54

0:16:05

0:16:05

0:00:54

0:00:54

0:46:53

0:46:53

0:45:22

0:45:22

0:03:29

0:03:29

0:00:05

0:00:05