filmov

tv

FINANCIAL ADVICE FOR 18 YEAR OLDS AND YOUNG ADULTS

Показать описание

So in this video, I'm going to break down 5 financial lessons I wish I knew when 18 and could officially make mistakes to ruin my entire future.

1. Car

- I hate care but depending where you live you might need to get one

- Get a beater car, meaning it cost less than $2000 bucks and will run for 4 years of A to B

- Do not get some fancy car

2. Fancy Expensive College

- Here is an interesting story you guys probably don’t know about

- I got rejected from my dream school 3 times

- I ended up going to private school with a combination of 35k in scholarship and a lot of government help ( which totaled my cost to be 13k for a year bachelors degree)

I tell you this:

- Because I hear about people that want to go fancy school but will have to take out a ton of money in student loan debt

- And they also pick the wrong career

- But the average millionaire goes to a normal college, so the expensive degree with eh student loan debt is usually a lot more marketing than you think.

Tip: But if you do plan on going to one of those schools. Apply to as many scholarships as possible, a minimum of 50. ( you can use an app called Scholly or ask your professors for grants according to your major or just search online)

Ps: Some people actually go to community college first and then to a better college for their bachelor's.

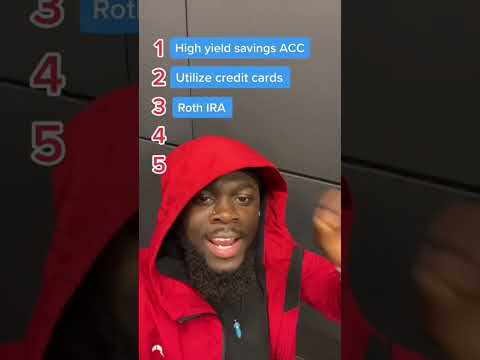

3. Get a Credit Card

- There is a right way to do it and a wrong way to do it

- And I did it the wrong way, but I just got extremely lucky

Why do you want to get a Credit Card:

- If you get a secured credit card for example

- You can start building your credit history and by the time you graduate

- Youll have a solid track record ( of over 4 years of good payments )

How to do this:

- Put all your auto-pay bills on the credit card, Phone Bill, Netflix, apply music and more

- And set the credit card to auto-pay every month

- That way you have no excuse ( and then just leave the card at home)

Tip: The Wrong way, is to think to build credit is you need to buy something expensive and pay it off over time, you don’t need to do that. It's going to cost you money.

4. Try different Things ( jobs and side hustles )

- Get a job but don’t be afraid to quite

- During this time you have to start experimenting to find out 3 things

- What are you good at, what do you like, and can it make you money

For example:

- Some of my friends just picked what they were good at and made them money: but they're not as happy as they should be

- When I was in college I had 4 different jobs, two I hated and two I loved. ( guess which ones paid the most, the ones I didn’t like but guess which ones pay the most today, the ones I like) – reselling, negotiating, and doing youtube.

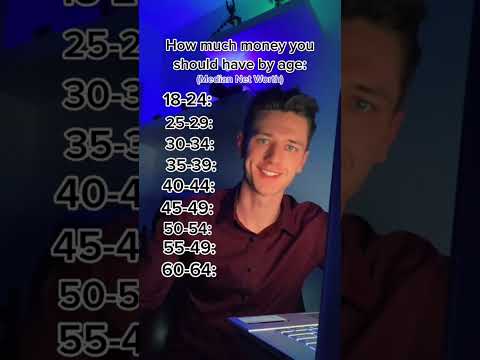

5. Pay Debt or Invest ( both are good )

- The safe bet is to pay off your student loan in those 4 years ( grants, scholarships and you have a job)

- The more risky one is to invest every dollar while you’re in college ( say you’ll be making ( 24k per year over 4 years you should have invested around 60k after expenses and taxes)

Here is the Math:

- Students Average: 36k and interest might be 4%: $1,440 or $120 per month

- Investments Growth 8% plus 2.83 Dividend on 60k: $4,800 in growth and $1698 ( with this math your dividend cover your debt for life )

- Which one is right: they are kinda both the same: if you paid it off in full, you graduate with zero debt and can probably invest that much money in the first year either way.

Tip: It's all up to you.

Bonus:

- You are the average of the 5 people you hang around, meaning that you become the people you hang around the most.

- Get an Online Bank Account

* PRO TIP*

INFORMATION IS EVERYTHING

💲My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

1. Car

- I hate care but depending where you live you might need to get one

- Get a beater car, meaning it cost less than $2000 bucks and will run for 4 years of A to B

- Do not get some fancy car

2. Fancy Expensive College

- Here is an interesting story you guys probably don’t know about

- I got rejected from my dream school 3 times

- I ended up going to private school with a combination of 35k in scholarship and a lot of government help ( which totaled my cost to be 13k for a year bachelors degree)

I tell you this:

- Because I hear about people that want to go fancy school but will have to take out a ton of money in student loan debt

- And they also pick the wrong career

- But the average millionaire goes to a normal college, so the expensive degree with eh student loan debt is usually a lot more marketing than you think.

Tip: But if you do plan on going to one of those schools. Apply to as many scholarships as possible, a minimum of 50. ( you can use an app called Scholly or ask your professors for grants according to your major or just search online)

Ps: Some people actually go to community college first and then to a better college for their bachelor's.

3. Get a Credit Card

- There is a right way to do it and a wrong way to do it

- And I did it the wrong way, but I just got extremely lucky

Why do you want to get a Credit Card:

- If you get a secured credit card for example

- You can start building your credit history and by the time you graduate

- Youll have a solid track record ( of over 4 years of good payments )

How to do this:

- Put all your auto-pay bills on the credit card, Phone Bill, Netflix, apply music and more

- And set the credit card to auto-pay every month

- That way you have no excuse ( and then just leave the card at home)

Tip: The Wrong way, is to think to build credit is you need to buy something expensive and pay it off over time, you don’t need to do that. It's going to cost you money.

4. Try different Things ( jobs and side hustles )

- Get a job but don’t be afraid to quite

- During this time you have to start experimenting to find out 3 things

- What are you good at, what do you like, and can it make you money

For example:

- Some of my friends just picked what they were good at and made them money: but they're not as happy as they should be

- When I was in college I had 4 different jobs, two I hated and two I loved. ( guess which ones paid the most, the ones I didn’t like but guess which ones pay the most today, the ones I like) – reselling, negotiating, and doing youtube.

5. Pay Debt or Invest ( both are good )

- The safe bet is to pay off your student loan in those 4 years ( grants, scholarships and you have a job)

- The more risky one is to invest every dollar while you’re in college ( say you’ll be making ( 24k per year over 4 years you should have invested around 60k after expenses and taxes)

Here is the Math:

- Students Average: 36k and interest might be 4%: $1,440 or $120 per month

- Investments Growth 8% plus 2.83 Dividend on 60k: $4,800 in growth and $1698 ( with this math your dividend cover your debt for life )

- Which one is right: they are kinda both the same: if you paid it off in full, you graduate with zero debt and can probably invest that much money in the first year either way.

Tip: It's all up to you.

Bonus:

- You are the average of the 5 people you hang around, meaning that you become the people you hang around the most.

- Get an Online Bank Account

* PRO TIP*

INFORMATION IS EVERYTHING

💲My Budget + Stock Investments💲

👕Merch👕

✅2 FREE AUDIOBOOKS✅

🎁ACORN FREE $5🎁

⚡FREE KINDLE UNLIMITED⚡ (traditional reading)

👨🏽💻DISCORD PRIVATE GROUP👨🏽💻

😎All My Social Media😎

*Some of the links and other products that appear on this video are from companies in which Tommy Bryson will earn an affiliate commission or referral bonus. Tommy Bryson is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. I'm an Accountant but I'm not your Accountant, always review information with your Accountant/CPA and your Financial Advisor.

Комментарии

0:18:54

0:18:54

0:21:51

0:21:51

0:00:20

0:00:20

0:08:46

0:08:46

0:00:57

0:00:57

0:17:17

0:17:17

0:05:17

0:05:17

0:17:13

0:17:13

0:45:37

0:45:37

0:00:59

0:00:59

0:04:57

0:04:57

0:00:33

0:00:33

0:10:14

0:10:14

0:20:17

0:20:17

0:00:12

0:00:12

0:31:58

0:31:58

0:00:49

0:00:49

0:00:38

0:00:38

0:04:53

0:04:53

0:01:00

0:01:00

0:08:43

0:08:43

0:16:18

0:16:18

0:00:58

0:00:58

0:15:31

0:15:31