filmov

tv

The Price/Value Feedback Loop: Revisiting AMC and GME!

Показать описание

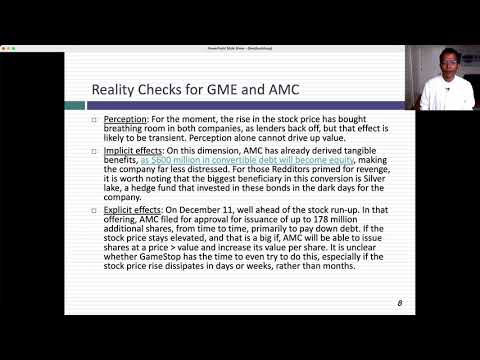

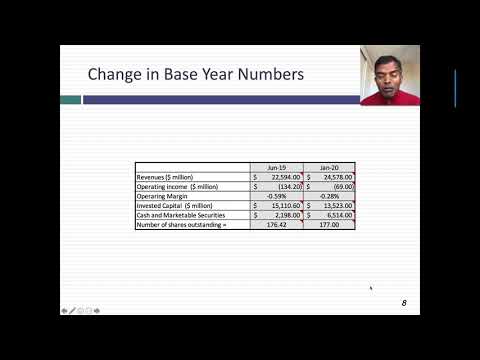

Value is driven by business models and fundamentals. Price is driven by mood and momentum. IN reasonably efficient market, they should converge, but what if they diverge? In this session, I look at how the price diverging from value (in either direction) can have a feedback effect on value. When a company's stock price soars past its value, the company benefits not just from perception, but also from fundamental changes that can occur to its business. Those changes can range from conversion of debt into equity and better employee retention (implicit) to new stock issuances at the higher price, to take advantage of the mis-pricing. Conversely, if a company's stock price drops below value, that not only negatively alters perception about the company, but it has fundamental consequences, increasing the debt load as a percent of value, and prompting employees to look for better places to work. For this company, buybacks can increase the value per share of the remaining shareholders. In this session, I look at the possibilities in both cases, and natural constraints on why they may not always deliver the results you expect them to deliver.

Комментарии

0:18:25

0:18:25

0:11:25

0:11:25

0:00:54

0:00:54

0:00:41

0:00:41

0:00:47

0:00:47

0:03:44

0:03:44

0:03:20

0:03:20

0:05:53

0:05:53

0:17:57

0:17:57

0:10:30

0:10:30

0:08:35

0:08:35

2:00:52

2:00:52

0:04:01

0:04:01

0:05:08

0:05:08

0:37:18

0:37:18

0:51:33

0:51:33

0:42:52

0:42:52

0:53:10

0:53:10

0:09:54

0:09:54

1:41:07

1:41:07

0:05:38

0:05:38

0:36:45

0:36:45

0:21:30

0:21:30

1:21:16

1:21:16