filmov

tv

An Ode to Luck: Revisiting Tesla in January 2020

Показать описание

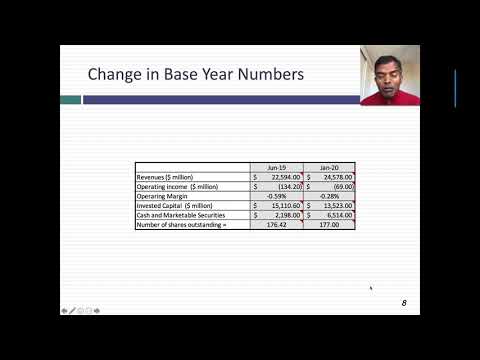

Tesla is a company that I have valued at least once a year for many years, and I have navigate a middle ground between those who love the company and those who hate. For most of Tesla's corporate life, I found Tesla to have potential but to be over priced, but in June 2019, I bought Tesla for the first time at $180. As luck would have it (and it was pure luck), the stock turned around and has not looked back since. Yesterday (January 29, 2020), the stock surged to hit $650 in the after-market after its most recent earnings call. I revisit and revalue the company in this session, and much as I want to continue to hold the company, I cannot justify continuing to hold it. I explain my reasoning, and you are welcome to disagree with it.

Blog Post:

Valuations

Blog Post:

Valuations

An Ode to Luck: Revisiting Tesla in January 2020

Putin vs Zelensky playing Piano

A Viral Market Update XI: An Ode to Flexibility

Ode To Exceed - 5 Things To Know (As the Best Dueling Battler Game Out There)

Ep230: Western Front Revisited

Rangeela | FC Time Machine | Urmila Matondkar | Aamir Khan | Jackie Shroff | Sucharita Tyagi

I Solved 1583 Leetcode Questions Here's What I Learned

What is a 'Linear' Differential Equation?

BABY Mode is TOO EASY.. (EASIEST Mode in BTD 6!)

16 Months in Outland – My TBC Story & Review

The Time North Korea & Romania Were Best Friends

An Adoption Story (S1): Iván's Discovery of His Birth Family Links in Russia and Armenia

Cotton Meets Kahn - King of the Hill

A Cosy Day at Home | Irish Cottage Garden | Living in Ireland Vlog | Silent Vlog

An Ode to Magic | Modern Horizons 3 Debut | Magic: The Gathering

Odhni Odhu to Udi Udi Jaye | Gujjubhai Most Wanted |Vikas A |Aishwarya Majmudar,Dawgeek, Advait N

Funeral For A Friend / Love Lies Bleeding (Remastered 2014)

The Games We Played in 2021 - New Favorites and Rediscovered Classics / MY LIFE IN GAMING

Best Episode of a Bad Era — Respect for Gordon

The Story of OldRoot: Minecraft's Strangest Mystery

Me and My Cello - Happy Together (Turtles) Cello Cover - The Piano Guys

'Achmed: Jingle Bombs' | Jeff Dunham's Very Special Christmas Special | JEFF DUNHAM

A Do-it-Yourself (DIY) Valuation of Tesla: Of Investment Regret and Disagreement!

100 car batteries wired in parallel!

Комментарии

0:17:57

0:17:57

0:00:28

0:00:28

0:25:59

0:25:59

0:10:24

0:10:24

0:39:49

0:39:49

0:11:26

0:11:26

0:20:37

0:20:37

0:19:15

0:19:15

0:15:33

0:15:33

0:40:35

0:40:35

0:22:31

0:22:31

0:33:46

0:33:46

0:00:21

0:00:21

0:19:29

0:19:29

0:29:11

0:29:11

0:03:15

0:03:15

0:11:07

0:11:07

1:19:02

1:19:02

0:10:20

0:10:20

0:37:36

0:37:36

0:03:22

0:03:22

0:05:20

0:05:20

0:19:51

0:19:51

0:38:23

0:38:23