filmov

tv

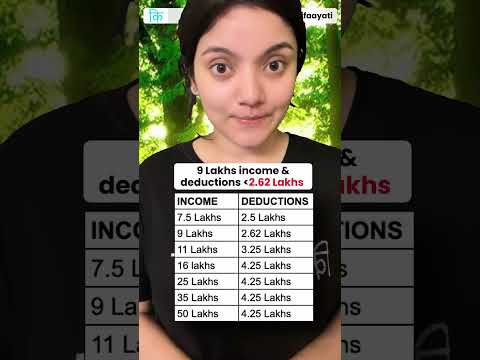

Standard Deduction in New Tax Regime Budget 2023 | Standard Deduction in Income Tax AY 2023-24

Показать описание

Standered Deduction in New Tax Regime Budget 2023 | Standard Deduction in Income Tax AY 2023-24

standard deduction in new tax regime

standard deduction in new tax regime budget 2023

standard deduction in new tax regime 2023 24

standard deduction in new tax regime 52500

standard deduction in new tax regime 2023

what is standard deduction in income tax

standard deduction kya hota hai

standard deduction under section 16(ia)

standard deduction in income tax 2023-24

----------------------------------------------------------------------------------------------------------------------------------------

standard deduction in new tax regime

standard deduction in new tax regime budget 2023

standard deduction in new tax regime 2023 24

standard deduction in new tax regime 52500

standard deduction in new tax regime 2023

what is standard deduction in income tax

standard deduction kya hota hai

standard deduction under section 16(ia)

standard deduction in income tax 2023-24

----------------------------------------------------------------------------------------------------------------------------------------

Standard Deduction Explained (Easy To Understand!))

IRS raises income threshold and standard deduction for all tax brackets

Standard Deduction in New Tax Regime FY 2024-25 | Standard Deduction in Old Tax Regime Income Tax

Standard Deduction in new tax? #LLAShorts 524

New tax regime | How to save income tax in FY24

Standard Deduction in New Tax Regime Budget 2023 | Standard Deduction in Income Tax AY 2023-24

Union Budget 2024: Changes in new tax regime; standard deduction increased | Tax slab

FM Announces Changes In New Tax Regime, Standard Deduction Increased To ₹75,000 From ₹50,000 |Budget...

Standard Deduction -How to save Tax | Salaried and Pensioners #incometaxefiling #stockmarketindia

New Tax Regime Deductions | Deduction in New Tax Regime | New Tax Regime Exemption FY 2024-25

New Tax Brackets and Rules in 2024 You Need to Know

Budget 2024: What is Standard Deduction whose Limit raised to Rs 75,000 Under the New Tax Regime?

Budget 2024: Income tax slabs to standard deduction to NPS, what changed for salaried individuals

What is my Standard Deduction?

Standard Deduction from Salary AY 24-25 | Standard Deduction in New Tax Regime | Standard Deduction

Standard Deduction Under Salary | CA Inter | Income Tax | CA Rohan Gupta

New Tax Regime vs Old Tax Regime SIMPLIFIED

Standard Deduction in New Tax Regime

Budget 2024: Tax Slab Changes To Standard Deduction To Big News For Investors: What For The Salaried

Zero tax on 7 lacs ! Really ? How ?

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

What is Standard Deduction under the Income Tax Act

No tax till 7 lakh - Shandar ya doglapan? Budget new tax slab - BUDGET 2023 #shorts #iafkshorts

Union Budget 2024 New Tax Regime | Standard Deduction Increased From 50,000 To 75,000 | India Today

Комментарии

0:07:18

0:07:18

0:02:10

0:02:10

0:04:05

0:04:05

0:01:00

0:01:00

0:10:48

0:10:48

0:05:41

0:05:41

0:00:53

0:00:53

0:02:31

0:02:31

0:01:00

0:01:00

0:08:11

0:08:11

0:11:15

0:11:15

0:02:11

0:02:11

0:08:13

0:08:13

0:07:04

0:07:04

0:01:41

0:01:41

0:05:27

0:05:27

0:00:47

0:00:47

0:00:53

0:00:53

0:03:34

0:03:34

0:01:00

0:01:00

0:16:59

0:16:59

0:02:12

0:02:12

0:00:59

0:00:59

0:16:39

0:16:39