filmov

tv

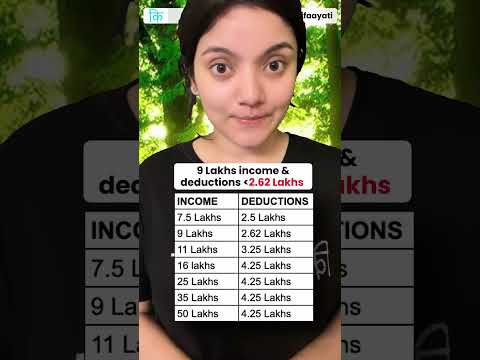

Standard Deduction in new tax? #LLAShorts 524

Показать описание

Get smarter with Masterclasses by LLA

Start your Investing Journey with the best Brokers👇

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Insurance is Important, Get one Now! 👇

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Standard Deduction ka Confusion?

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Shot & Edited by: Naveen, Rohan Agarwal

Presented by: Jagruk RJ

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Follow us on Social Media📲

#Shorts #LLA #budget2023 #budget

Start your Investing Journey with the best Brokers👇

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Insurance is Important, Get one Now! 👇

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Standard Deduction ka Confusion?

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Shot & Edited by: Naveen, Rohan Agarwal

Presented by: Jagruk RJ

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

Follow us on Social Media📲

#Shorts #LLA #budget2023 #budget

Standard Deduction Explained (Easy To Understand!))

IRS raises income threshold and standard deduction for all tax brackets

Standard Deduction in New Tax Regime FY 2024-25 | Standard Deduction in Old Tax Regime Income Tax

Standard Deduction in new tax? #LLAShorts 524

New tax regime | How to save income tax in FY24

Standard Deduction in New Tax Regime Budget 2023 | Standard Deduction in Income Tax AY 2023-24

Union Budget 2024: Changes in new tax regime; standard deduction increased | Tax slab

FM Announces Changes In New Tax Regime, Standard Deduction Increased To ₹75,000 From ₹50,000 |Budget...

Best Tax Slab for Your Income | Old vs New Tax Regime: Which is Better?

New Tax Regime Deductions | Deduction in New Tax Regime | New Tax Regime Exemption FY 2024-25

New Tax Brackets and Rules in 2024 You Need to Know

Budget 2024: What is Standard Deduction whose Limit raised to Rs 75,000 Under the New Tax Regime?

Standard Deduction from Salary AY 24-25 | Standard Deduction in New Tax Regime | Standard Deduction

Standard Deduction Under Salary | CA Inter | Income Tax | CA Rohan Gupta

New Tax Regime vs Old Tax Regime SIMPLIFIED

What is my Standard Deduction?

Budget 2024: Income tax slabs to standard deduction to NPS, what changed for salaried individuals

Standard Deduction in New Tax Regime

Zero tax on 7 lacs ! Really ? How ?

Budget 2024: Tax Slab Changes To Standard Deduction To Big News For Investors: What For The Salaried

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

No tax till 7 lakh - Shandar ya doglapan? Budget new tax slab - BUDGET 2023 #shorts #iafkshorts

What is Standard Deduction under the Income Tax Act

Union Budget 2024 New Tax Regime | Standard Deduction Increased From 50,000 To 75,000 | India Today

Комментарии

0:07:18

0:07:18

0:02:10

0:02:10

0:04:05

0:04:05

0:01:00

0:01:00

0:10:48

0:10:48

0:05:41

0:05:41

0:00:53

0:00:53

0:02:31

0:02:31

0:05:12

0:05:12

0:08:11

0:08:11

0:11:15

0:11:15

0:02:11

0:02:11

0:01:41

0:01:41

0:05:27

0:05:27

0:00:47

0:00:47

0:07:04

0:07:04

0:08:13

0:08:13

0:00:53

0:00:53

0:01:00

0:01:00

0:03:34

0:03:34

0:16:59

0:16:59

0:00:59

0:00:59

0:02:12

0:02:12

0:16:39

0:16:39