filmov

tv

Medi-Cal Eligibility Updates for 2023

Показать описание

In a groundbreaking development, California has reformed Medi-Cal eligibility rules, drastically increasing the resource limit for disabled individuals. Starting January 2024, these resource limits will be entirely eliminated. What implications does this have for you or your loved ones, especially those who might receive a large inheritance or other financial gains?

In this comprehensive video, we delve into the nuances of these Medi-Cal eligibility changes, from the raised resource limits to the remaining income restrictions. We discuss how this affects Supplemental Security Income (SSI), planning for potential large sums of money, and considerations if you are thinking about moving states.

Tune in for a complete guide to navigate these substantial changes and make informed decisions that could affect your benefits and financial security. Whether you're looking to safeguard your benefits or plan for a potential windfall, this video is your go-to resource for understanding and preparing for Medi-Cal's new landscape.

00:00 Introduction

0:45 Medi-Cal Resource Limit Change

1:35 January 2024 - No More Resource Limit

2:22 Supplemental Security Income (SSI) Limit

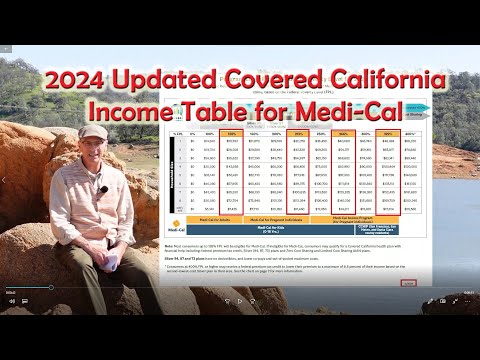

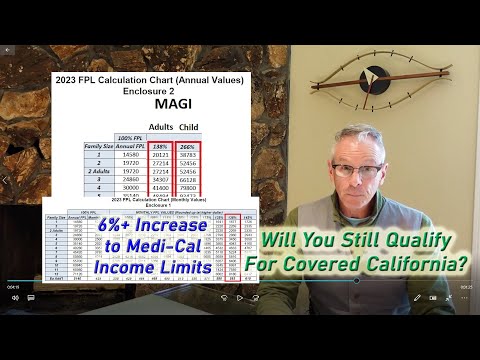

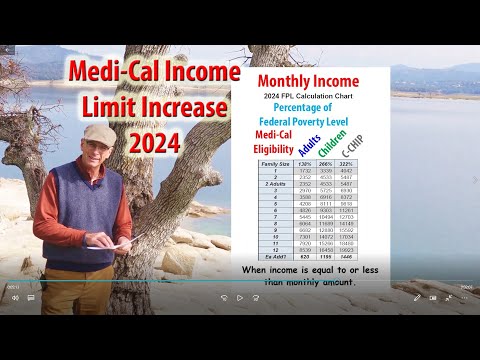

3:09 Medi-Cal Income Limit

5:35 Social Security Disability Insurance (SSDI) & Medicare

✅ Schedule Call with Intake Team 👇👇

✅ Please Subscribe to my channel I put out a new video every week →

✅ Download the Estate Planning Webinar 👇👇

✅ FREE Parenting When You’re Gone Guide 👇👇

✅ Download the Limited Conservatorship Webinar 👇👇

💥 Follow me on Social Media 💥

Looking forward to connecting!

Please call or text with any Estate Planning questions: (650) 690-2571

The content of this YouTube channel is provided for informational purposes only and is not intended to constitute legal advice. You should not rely upon any information contained on this YouTube channel for legal advice. Viewing this YouTube channel is not intended to and shall not create an attorney-client relationship between you and Ellen Cookman or Cookman Law, PC. Messages or other forms of communication that you transmit to this YouTube channel will not create an attorney-client relationship and thus information contained in such communications may not be protected as privileged. Neither Ellen Cookman nor Cookman Law, PC makes any representation, warranty, or guarantee about the accuracy of the information contained in this YouTube channel or in links to other YouTube channels or websites. This YouTube channel is provided "as is," and does not represent any outcome or result from viewing this channel. Your use viewing of this YouTube channel is at your own risk. You enjoy this YouTube channel and its contents only for personal, non-commercial purposes. Neither Ellen Cookman, Cookman Law, PC, nor anyone acting on their behalf, will be liable under any circumstances for damages of any kind.

© 2022 Cookman Law. All rights reserved.

#estateplan #eligibility #ellencookman #resourcelimit #updates

In this comprehensive video, we delve into the nuances of these Medi-Cal eligibility changes, from the raised resource limits to the remaining income restrictions. We discuss how this affects Supplemental Security Income (SSI), planning for potential large sums of money, and considerations if you are thinking about moving states.

Tune in for a complete guide to navigate these substantial changes and make informed decisions that could affect your benefits and financial security. Whether you're looking to safeguard your benefits or plan for a potential windfall, this video is your go-to resource for understanding and preparing for Medi-Cal's new landscape.

00:00 Introduction

0:45 Medi-Cal Resource Limit Change

1:35 January 2024 - No More Resource Limit

2:22 Supplemental Security Income (SSI) Limit

3:09 Medi-Cal Income Limit

5:35 Social Security Disability Insurance (SSDI) & Medicare

✅ Schedule Call with Intake Team 👇👇

✅ Please Subscribe to my channel I put out a new video every week →

✅ Download the Estate Planning Webinar 👇👇

✅ FREE Parenting When You’re Gone Guide 👇👇

✅ Download the Limited Conservatorship Webinar 👇👇

💥 Follow me on Social Media 💥

Looking forward to connecting!

Please call or text with any Estate Planning questions: (650) 690-2571

The content of this YouTube channel is provided for informational purposes only and is not intended to constitute legal advice. You should not rely upon any information contained on this YouTube channel for legal advice. Viewing this YouTube channel is not intended to and shall not create an attorney-client relationship between you and Ellen Cookman or Cookman Law, PC. Messages or other forms of communication that you transmit to this YouTube channel will not create an attorney-client relationship and thus information contained in such communications may not be protected as privileged. Neither Ellen Cookman nor Cookman Law, PC makes any representation, warranty, or guarantee about the accuracy of the information contained in this YouTube channel or in links to other YouTube channels or websites. This YouTube channel is provided "as is," and does not represent any outcome or result from viewing this channel. Your use viewing of this YouTube channel is at your own risk. You enjoy this YouTube channel and its contents only for personal, non-commercial purposes. Neither Ellen Cookman, Cookman Law, PC, nor anyone acting on their behalf, will be liable under any circumstances for damages of any kind.

© 2022 Cookman Law. All rights reserved.

#estateplan #eligibility #ellencookman #resourcelimit #updates

Комментарии

0:06:51

0:06:51

0:02:19

0:02:19

1:26:23

1:26:23

0:26:15

0:26:15

0:07:15

0:07:15

0:03:21

0:03:21

0:07:36

0:07:36

0:02:48

0:02:48

0:08:28

0:08:28

0:01:53

0:01:53

0:05:45

0:05:45

0:01:15

0:01:15

0:06:52

0:06:52

0:33:17

0:33:17

0:07:21

0:07:21

0:08:09

0:08:09

0:04:43

0:04:43

0:01:41

0:01:41

0:01:08

0:01:08

0:01:01

0:01:01

0:01:36

0:01:36

0:34:23

0:34:23

0:02:47

0:02:47

0:57:07

0:57:07