filmov

tv

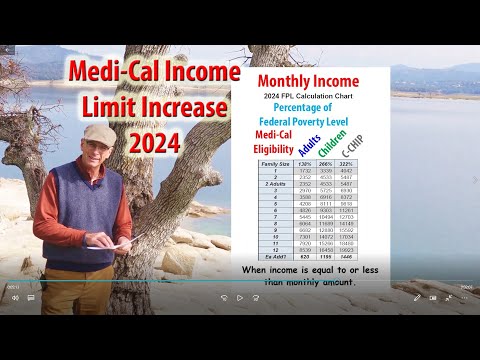

Higher Medi-Cal Income Limits of 3.3% for 2024

Показать описание

The federal poverty level for 2024 increased 3.3% over 2023. This means that individuals and families can earn more money per month and retain their MAGI Medi-Cal eligibility. I review the monthly and annual income amounts for adults and children.

Higher Medi-Cal Income Limits of 3.3% for 2024

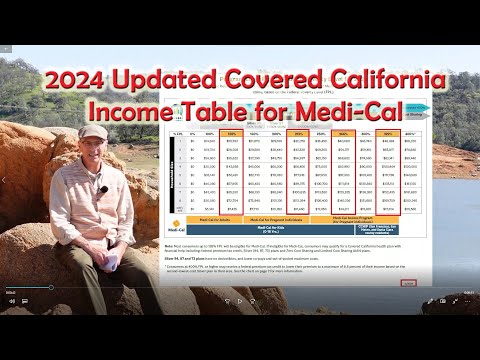

2024 Covered California Medi-Cal Updated Income Table

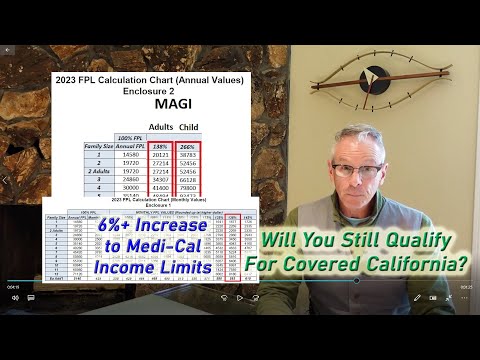

2023 Medi Cal Income Limits Increase Over 6%

Medicaid Eligibility - Medicaid Income and Asset Limits – 2024

Medi-Cal Asset Limit Removed Beginning in 2024

What Is Medi-Cal? (Part 1)

Medi-Cal Eligibility Updates for 2023

What Are the Income Limits for Medi-Cal Eligibility? - InsuranceGuide360.com

House Gave Approval! $1200/Mo One-Time Checks Hitting Banks This Friday For SSI SSDI VA Seniors

Medicare Income Limits for 2023 | How Much Income is Too Much? 🤔

How do I qualify for Medi-Cal in California?

How much income can you have for Medicaid?

Medi-Cal Monthly vs. Covered California Annual Income Issues

2024 MEDI CAL No Asset Limits

2022 MAGI Medi Cal Income Limits

New Higher Medi-Cal Asset Limits for Medicare and Long-Term Care Expenses

Medi-Cal FAQ's / Understanding Asset Limits / UPDATED

Medical vs Covered CA Eligibility

Medi-Cal Financial Eligibility Based On Modified Adjusted Gross Income

Understanding Medi-Cal / UPDATED

Medical Income Limit 2023: What You Need to Know #medical #income #limit #california #insurance

How Does Income Affect Medi-Cal and Other Public Benefits?

Learn More About Correctly Reporting Your Income | Covered California

5 Medi Cal Eligibility Categories for People with Disabilities

Комментарии

0:07:21

0:07:21

0:07:36

0:07:36

0:05:45

0:05:45

0:01:53

0:01:53

0:07:15

0:07:15

0:03:21

0:03:21

0:06:51

0:06:51

0:03:19

0:03:19

2:43:30

2:43:30

0:23:16

0:23:16

0:02:48

0:02:48

0:01:57

0:01:57

0:06:51

0:06:51

0:00:40

0:00:40

0:06:53

0:06:53

0:05:40

0:05:40

0:02:50

0:02:50

0:01:15

0:01:15

0:01:36

0:01:36

0:08:28

0:08:28

0:00:50

0:00:50

0:13:09

0:13:09

0:02:47

0:02:47

0:33:17

0:33:17