filmov

tv

Corporate losses in the U.S. from coronavirus will top $4 trillion: Bridgewater founder Ray Dalio

Показать описание

“What’s happening has not happened in our lifetime before ... What we have is a crisis,” Dalio said in a “Squawk Box” interview. “There will also be individuals who have very big losses. ... There’s a need for the government to spend more money, a lot more money.”

The total U.S. GDP at the end of 2019 was more than $21 trillion. The founder of the Bridgewater Associates hedge fund also estimated the global corporate losses will amount to $12 trillion due to the pandemic.

For more coronavirus live updates:

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBC TV

Corporate losses in the U.S. from coronavirus will top $4 trillion: Bridgewater founder Ray Dalio

After 2020 Loss, Trump's Tax Cuts Endure As Corporations Duck U.S. Debts | The Beat With Ari Me...

What does a US rate cut mean for Americans and the rest of us? | Counting the Cost

6.6 million file for unemployment: Historic job losses in the US | ABC News

Excess Loss Account | Section 1502 (U.S. Tax)

Why are some US firms announcing losses from Trump's tax reforms?

US banks face potential big loan losses: Finance expert

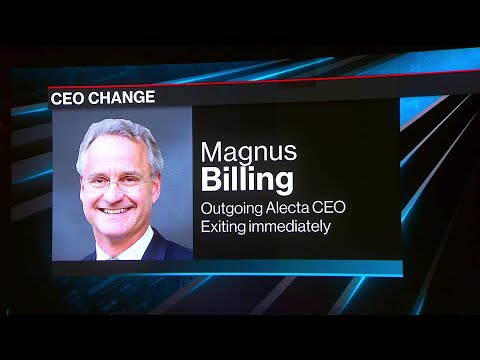

Sweden's Alecta Forces Out CEO After US Bank Losses

US Fed Meeting LIVE: US Fed Cuts Rates By 50 Basis Points | Jerome Powell LIVE | FOMC Meeting | N18G

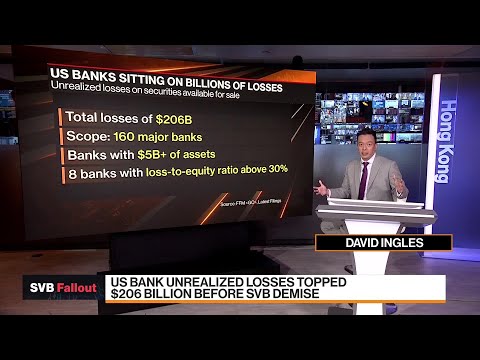

US Banks Sitting on Billions of Losses

U.S. banks had $620 billion in unrealized losses in 2022: FDIC

Over 1200 workers starring at a job loss as Base Titanium is set to close down in Kwale County

#Shorts | Carry-Forward Losses & Tax Loss Harvesting for U.S. Expats

'Weapons Shortage': U.S. Cries As Russia Hammers Ukraine | 'Washington To Delay Aid S...

Weekly Recap: Fed Cuts! China Slowdown, U.S. Fiscal Bomb & Crypto Eureka

🔴 ALERT: U.S. Banks Report Losses & Increase Reserves for Losses Amid 23% Surge in Delinquencies...

Loss of Purchasing Power and Increased Finance Charges: $8,000 Annual Impact! #economy #inflation

U.S. banks set aside billions for potential loan losses

US Tax Reform: Net Operating Losses (4 of 11)

U.S. stocks see biggest loss in 2 years after CPI data

Massive job losses were expected from coronavirus lockdowns: Former U.S. Treasury Secretary

U.S. debt default would spark job losses across the country

Pope’s visit, anti-vax protest, U.S. Open loss: World in Photos Sept. 13

U.S. job losses in April worst since Great Depression

Комментарии

0:04:19

0:04:19

0:11:38

0:11:38

0:28:01

0:28:01

0:05:05

0:05:05

0:04:04

0:04:04

0:04:45

0:04:45

0:05:23

0:05:23

0:01:31

0:01:31

8:09:21

8:09:21

0:02:06

0:02:06

0:05:50

0:05:50

0:03:01

0:03:01

0:00:55

0:00:55

0:03:37

0:03:37

0:59:49

0:59:49

0:09:36

0:09:36

0:00:57

0:00:57

0:01:26

0:01:26

0:04:19

0:04:19

0:02:03

0:02:03

0:06:43

0:06:43

0:04:59

0:04:59

0:02:06

0:02:06

0:01:08

0:01:08