filmov

tv

Interest Rate Parity (IRP) Explained | Foreign Exchange Rates

Показать описание

Join Ryan O'Connell, CFA, FRM, as he unravels the crucial concept of Interest Rate Parity (IRP) and its significant impact on foreign exchange markets. This comprehensive guide explains the Interest Rate Parity condition, essential for understanding currency relationships and identifying potential arbitrage opportunities. Learn the IRP formula and watch Ryan demonstrate its practical application using real market data to solve for forward exchange rates. Whether you're a finance professional, forex enthusiast, or economics student, this video provides valuable insights into how Interest Rate Parity shapes global currency dynamics and influences international investment decisions.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 Freelance Financial Modeling Services:

Chapters:

0:00 - Interest Rate Parity (IRP) Definition

1:29 - Interest Rate Parity Formula

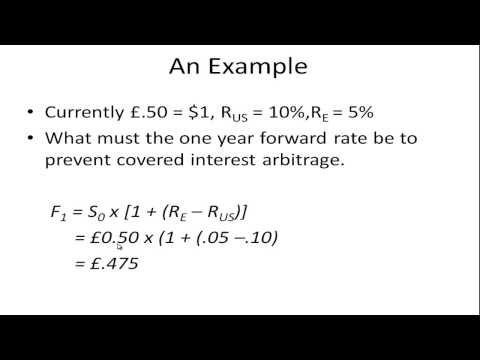

4:38 - Solving For Forward Rate W/ Real Data

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 Freelance Financial Modeling Services:

Chapters:

0:00 - Interest Rate Parity (IRP) Definition

1:29 - Interest Rate Parity Formula

4:38 - Solving For Forward Rate W/ Real Data

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Комментарии

0:08:06

0:08:06

0:01:58

0:01:58

0:07:53

0:07:53

0:01:26

0:01:26

0:01:18

0:01:18

0:02:38

0:02:38

0:05:01

0:05:01

0:03:32

0:03:32

0:09:20

0:09:20

0:04:26

0:04:26

0:14:18

0:14:18

0:03:45

0:03:45

0:05:51

0:05:51

0:15:32

0:15:32

0:02:57

0:02:57

0:05:31

0:05:31

0:08:02

0:08:02

0:06:02

0:06:02

0:15:44

0:15:44

0:28:52

0:28:52

0:02:45

0:02:45

0:23:40

0:23:40

0:07:46

0:07:46

0:12:05

0:12:05