filmov

tv

Covered and Uncovered Interest Parity ECN 382

Показать описание

CFA Level 2 | Economics: Covered and Uncovered Interest Rate Parity

Covered and Uncovered Interest Parity ECN 382

Uncovered Interest Rate Parity !

Uncovered Interest Parity and the Carry Trade

Covered Vs Uncovered Interest Rate Parity | FRM Part 1 | CFA Level 2

uncovered interest parity and arbitrage 16

Interest Rate Parity (IRP) Explained | Foreign Exchange Rates

Covered Interest Parity

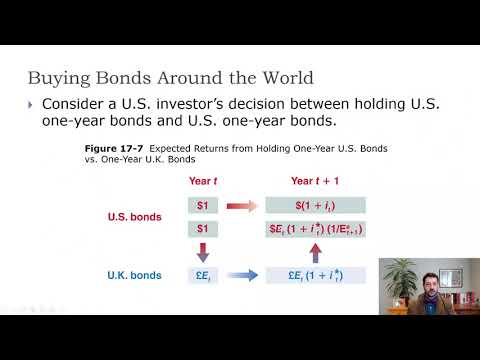

Macro-Ch17-Uncovered Interest Parity

(13 of 18) Ch.21 - Uncovered interest parity

INTEREST ARBITRAGE-COVERED AND UNCOVERED INTEREST ARBITRAGE

CFA® Level II Economics - International Parity Conditions

Uncovered Interest Parity Condition #indianeconomicservices #rbigradeb #upsc #ugcneteconomics#macro

Covered Interest Parity Explained

Uncovered Interest Parity

Covered Interest Arbitrage Explained

The Carry Trade and Uncovered Interest Rate Parity -Professor Jagjit Chadha

Covered Interest Rate Parity

Interest Rate Parity Made Easy!

Uncovered Interest Parity (UIP)

What Is Covered Interest Rate Parity?

Unit 5 chap 6 part 2| Interest Parity| Decision to borrow| Covered and uncovered interest parity|

Level II Concept: International parity conditions

Open Economy Macroeconomics: Interest Rate Parity

Комментарии

0:04:33

0:04:33

0:09:20

0:09:20

0:01:26

0:01:26

0:05:31

0:05:31

0:15:44

0:15:44

0:12:03

0:12:03

0:08:06

0:08:06

0:06:02

0:06:02

0:09:40

0:09:40

0:03:51

0:03:51

0:07:52

0:07:52

0:15:32

0:15:32

0:01:37

0:01:37

0:14:43

0:14:43

0:05:03

0:05:03

0:07:54

0:07:54

0:49:48

0:49:48

0:33:04

0:33:04

0:07:53

0:07:53

0:05:21

0:05:21

0:02:45

0:02:45

0:17:27

0:17:27

0:08:37

0:08:37

0:08:30

0:08:30