filmov

tv

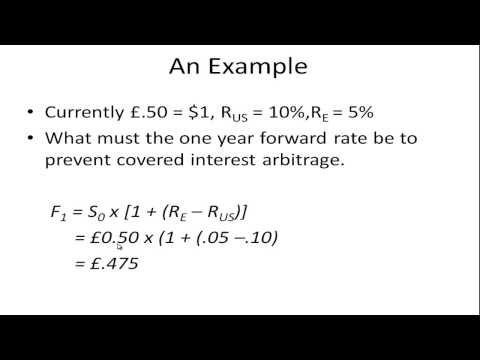

Interest Rate Parity

Показать описание

Created with Corel VideoStudio.

Interest Rate Parity

Interest Rate Parity Made Easy!

Interest Rate Parity (IRP) Explained | Foreign Exchange Rates

What is an Interest Rate Parity?

Uncovered Interest Rate Parity !

Interest Rate Parity

Interest Rate Parity

Interest rate parity - why it works

Facing headwinds: Navigating global market turbulence

(9 of 18) Ch.21 - Interest rate parity explained

How interest rates affect interest rates, financial flows, and exchange rates

How Does Interest Rate Parity (IRP) Work?

Covered and Uncovered Interest Parity ECN 382

Interest Rate Parity Theory (Forex) | CMA/CA Final SFM | CFA Level 2 Classes & Videos

Interest Rate Parity (IRP)

FIN 338 Interest Rate Parity

Derivation of Interest Rate Parity

Covered Interest Arbitrage and Interest Rate Parity | International Finance

CFA® Level II Economics - International Parity Conditions

Covered Vs Uncovered Interest Rate Parity | FRM Part 1 | CFA Level 2

Covered Interest Parity

Lecture 34: PPP Theory, Interest Rate Parity Theory, Fischer Effect, Numericals

Interest Rate Parity Theory, IRPT, Exchange rate theories, Foreign Exchange and Risk Management,

Interest Rate Parity: A Caveat

Комментарии

0:01:58

0:01:58

0:07:53

0:07:53

0:08:06

0:08:06

0:01:18

0:01:18

0:01:26

0:01:26

0:03:32

0:03:32

0:05:51

0:05:51

0:04:26

0:04:26

0:52:04

0:52:04

0:14:18

0:14:18

0:07:45

0:07:45

0:02:38

0:02:38

0:09:20

0:09:20

0:12:05

0:12:05

0:05:01

0:05:01

0:09:19

0:09:19

0:07:30

0:07:30

0:23:40

0:23:40

0:15:32

0:15:32

0:15:44

0:15:44

0:06:02

0:06:02

0:28:52

0:28:52

0:21:25

0:21:25

0:06:27

0:06:27