filmov

tv

Basic personal finance math

Показать описание

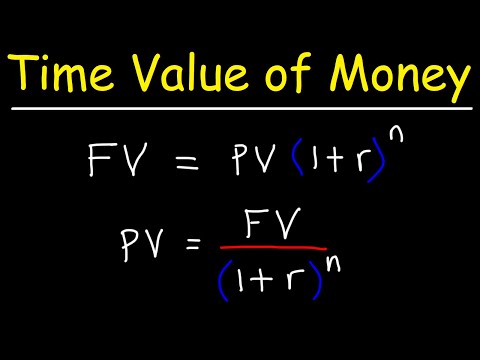

One thing that discourages most people from starting their personal finance journeys is that they get intimidated by all the numbers. That's a travesty because most of the math you need to know about personal finance is straightforward. In this video, Karthik, explains how to measure mutual fund returns and the time value of money. By the end of this video, you will be relieved that this isn't all that complicated and be a little more confident.

Basic personal finance math

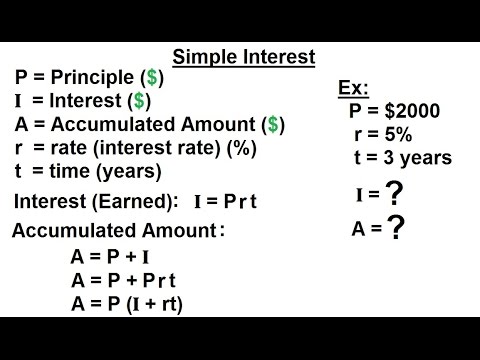

GCSE Maths - How to Calculate Simple Interest #95

Business Math - Finance Math (1 of 30) Simple Interest

Personal Finance - Assets, Liabilities, & Equity

Financial Literacy for Kids | Learn the basics of finance and budgeting

Math for Quantatative Finance

Basic personal finance math (Link to full video in description)

7th Grade Math Personal Financial Literacy: Calculating Personal Budget

Trump Bitcoin Comments, How To Use Cryptos: Monero vs. Bitcoin, Cash vs. Trackable Digital Currency

Time Value of Money - Present Value vs Future Value

Beginners guide to personal finance

Basics Math: personal finance [27/28]

How much money is in your bank account? 🤔💰 #shorts #finance #interview

1. Introduction, Financial Terms and Concepts

Financial Literacy - Full Video

The Regrets of An Accounting Major @zoeunlimited

A Banker's Career Advice for Young Adults

10 Personal Finance Rules School Doesn't Teach You

Cash Course: What Is A Budget? | Kids Shows

Robert Kiyosaki: This is the Best Investment Now!🔥📈 #money #investing #finance #robertkiyosaki

Mathematics G9 Personal and Household Finance Part 1

MATH Tip as easy as 1 2 3 (Guaranteed) #shorts #finance #math

7th Grade Math Personal Financial Literacy: Simple and Compound Interest

Warren Buffet explains how one could've turned $114 into $400,000 by investing in S&P 500 i...

Комментарии

0:08:54

0:08:54

0:04:05

0:04:05

0:04:58

0:04:58

0:02:38

0:02:38

0:06:14

0:06:14

0:05:37

0:05:37

0:00:33

0:00:33

0:05:00

0:05:00

0:11:59

0:11:59

0:05:14

0:05:14

0:07:14

0:07:14

0:09:15

0:09:15

0:00:38

0:00:38

1:00:30

1:00:30

0:16:17

0:16:17

0:00:37

0:00:37

0:00:59

0:00:59

0:10:03

0:10:03

0:04:46

0:04:46

0:01:00

0:01:00

0:10:30

0:10:30

0:00:19

0:00:19

0:05:00

0:05:00

0:00:50

0:00:50