filmov

tv

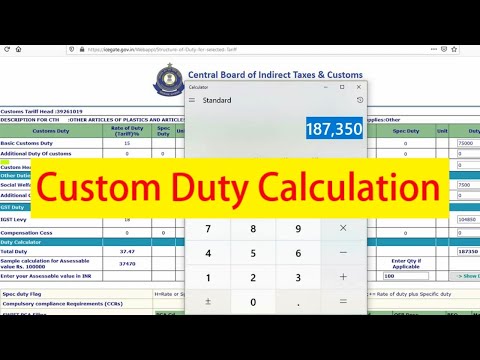

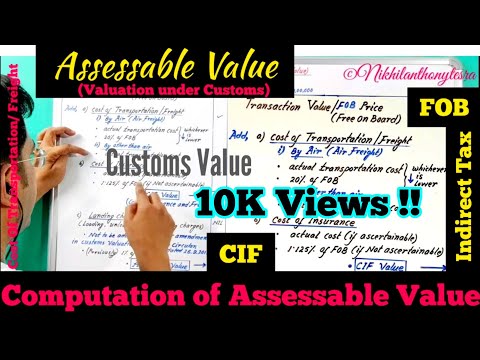

Calculate Custom Duty and IGST on Bill of Entry in India | in Hindi | Easiest Method | SCY016

Показать описание

How to calculate Custom Duty & IGST on Imported Products in India

Team

SCY

Your kind suggestion and advises are always welcomed.

You may please watch our previous videos as per below given links:-

(Introduction to the Channel / Supply Chain Yukti)

(What is Supply Chain? Explained in Hindi - Part 1 - Supply Chain Yukti - SCY 002)

(What is Supply Chain MANAGEMENT? Explained in Hindi - Part 2 - Supply Chain Yukti - SCY 003)

(Importance, Benefits & Need of Supply Chain Management or SCM - Supply Chain Yukti - SCY 004)

(Myth or Miss-conceptions about Supply Chain Management - SCM | 005 SCY | Supply Chain Yukti)

(Components of Supply Chain Management in Hindi | SCY 006 | Supply Chain Yukti | SCM Components of Supply Chain Management in Hindi | SCY 006 | Supply Chain Yukti | SCM)

(What is Sourcing? Stages of Sourcing in SCM in Hindi | SCY 007 | Supply Chain Yukti | SCM)

(What is Procurement? Types, Process and Components of Procurement in Hindi by Supply Chain Yukti | SCY 008 | Supply Chain Yukti | SCM)

(What is Logistics in Supply Chain? in Hindi | SCY009 | SCM | SCY)

(How Demand and Supply effects your Business's Supply Chain Management? in Hindi | SCY010 | SCM | SCY)

(How amazon became successful leader in e-commerce through Supply Chain Management? in Hindi | SCY011)

(Rich Mind vs Poor Mind | a deep thought on Supply Chain Management | in Hindi | SCY012 Supply Chain)

(What is business? in Hindi | Why most of the people fail? How to achieve success? SCY013)

(Why mostly Business fail? How to achieve success in Business? in Hindi | SCY014 | Part 2)

(All about Purchase Order or PO | in Hindi | Need, Purpose, Template, Components of PO | SCY015)

Team

SCY

Your kind suggestion and advises are always welcomed.

You may please watch our previous videos as per below given links:-

(Introduction to the Channel / Supply Chain Yukti)

(What is Supply Chain? Explained in Hindi - Part 1 - Supply Chain Yukti - SCY 002)

(What is Supply Chain MANAGEMENT? Explained in Hindi - Part 2 - Supply Chain Yukti - SCY 003)

(Importance, Benefits & Need of Supply Chain Management or SCM - Supply Chain Yukti - SCY 004)

(Myth or Miss-conceptions about Supply Chain Management - SCM | 005 SCY | Supply Chain Yukti)

(Components of Supply Chain Management in Hindi | SCY 006 | Supply Chain Yukti | SCM Components of Supply Chain Management in Hindi | SCY 006 | Supply Chain Yukti | SCM)

(What is Sourcing? Stages of Sourcing in SCM in Hindi | SCY 007 | Supply Chain Yukti | SCM)

(What is Procurement? Types, Process and Components of Procurement in Hindi by Supply Chain Yukti | SCY 008 | Supply Chain Yukti | SCM)

(What is Logistics in Supply Chain? in Hindi | SCY009 | SCM | SCY)

(How Demand and Supply effects your Business's Supply Chain Management? in Hindi | SCY010 | SCM | SCY)

(How amazon became successful leader in e-commerce through Supply Chain Management? in Hindi | SCY011)

(Rich Mind vs Poor Mind | a deep thought on Supply Chain Management | in Hindi | SCY012 Supply Chain)

(What is business? in Hindi | Why most of the people fail? How to achieve success? SCY013)

(Why mostly Business fail? How to achieve success in Business? in Hindi | SCY014 | Part 2)

(All about Purchase Order or PO | in Hindi | Need, Purpose, Template, Components of PO | SCY015)

Комментарии

0:06:52

0:06:52

0:17:55

0:17:55

0:04:34

0:04:34

0:04:40

0:04:40

0:07:21

0:07:21

0:08:19

0:08:19

0:00:53

0:00:53

0:05:06

0:05:06

0:12:15

0:12:15

0:02:48

0:02:48

0:07:57

0:07:57

0:10:01

0:10:01

0:05:38

0:05:38

0:25:24

0:25:24

0:14:05

0:14:05

0:08:14

0:08:14

0:10:08

0:10:08

0:00:58

0:00:58

0:16:22

0:16:22

0:31:28

0:31:28

0:03:50

0:03:50

0:05:23

0:05:23

0:03:05

0:03:05

0:13:00

0:13:00