filmov

tv

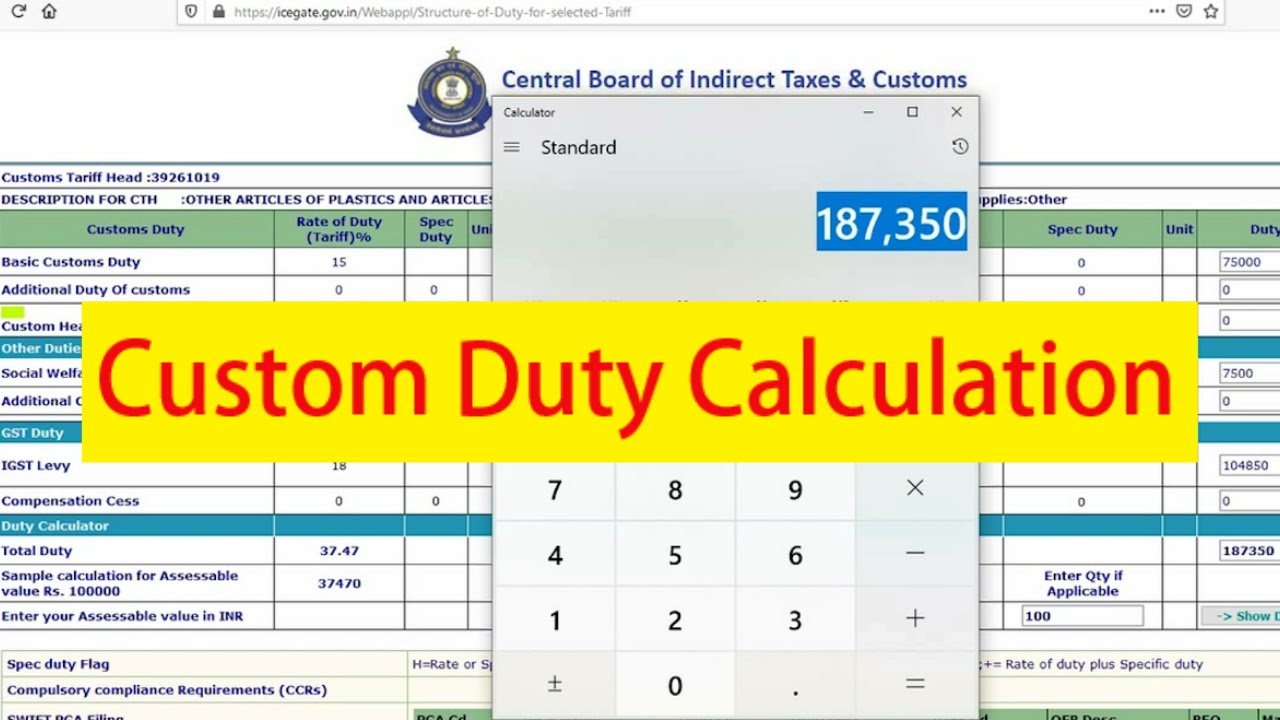

Calculate Custom Duty after GST in India | Import Duty calculation

Показать описание

This video will show you how to calculate TOTAL CUSTOM DUTY after GST on imports.

For more information about Freight Forwarding services,

visit,

or

Call/Whatsapp: 9289-700-700

For more information about Freight Forwarding services,

visit,

or

Call/Whatsapp: 9289-700-700

Calculate Custom Duty after GST in India | Import Duty calculation

What is Custom Duty and how to calculate it after GST in India?

Basic knowledge of Customs Duty/Tariff

how to calculate import duty in india Tamil

Know How to Calculate Import Duty after GST with custom import duty

How to calculate Import Tax & GST | Australia | Custom Calculator Included [STEP BY STEP EXPLAI...

Calculate Custom Duty and IGST on Bill of Entry in India | in Hindi | Easiest Method | SCY016

How to Calculate Import duty and IGST in Import Export Business By Sagar Agravat

Promotion 2025 | Exam Preparation | MSME PART 1 | Question & Answer CASA Products | CANSOUL by C...

Explaining Custom Duty in India | How much you need to pay to clear custom?

Custom Duty after GST

How to calculate Export Duty in Costing - Explained | PWIP

How to calculate import duty and VAT/GST

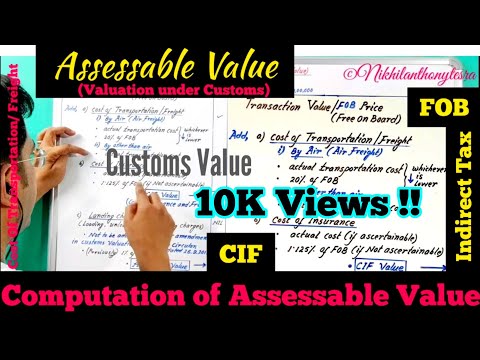

Computation of Assessable Value|Valuation under Customs| Indirect Tax|FOB|CIF|Customs Value

How duties and taxes are calculated

How to Calculate Customs Duty and IGST on imported Goods I How to Calculate Customs Duty II Type-1

How do I calculate the import customs duties?

How to calculate Assessable value for customs duty

How to Calculate Custom Charges in Pakistan!!! l import duty in Pakistan l @ubhertasitara

How to Calculate Custom Duty in Pakistan | Product Custom Duty @ImportandExportwithUsman

Calculation of#Import Duty After #GST in India (Hindi)

How to calculate custom duty and VAT when importing into the UK? [Step by step guide]

Import Duty Tax Calculation App | WeBOC Duty Tax Calculator

How to calculate customs duties

Комментарии

0:04:34

0:04:34

0:00:41

0:00:41

0:08:29

0:08:29

0:08:19

0:08:19

0:00:41

0:00:41

0:04:06

0:04:06

0:06:52

0:06:52

0:04:40

0:04:40

1:54:08

1:54:08

0:16:22

0:16:22

0:10:16

0:10:16

0:07:15

0:07:15

0:12:37

0:12:37

0:05:06

0:05:06

0:02:48

0:02:48

0:17:55

0:17:55

0:03:03

0:03:03

0:10:01

0:10:01

0:07:17

0:07:17

0:08:33

0:08:33

0:16:58

0:16:58

0:06:12

0:06:12

0:00:31

0:00:31

0:00:58

0:00:58