filmov

tv

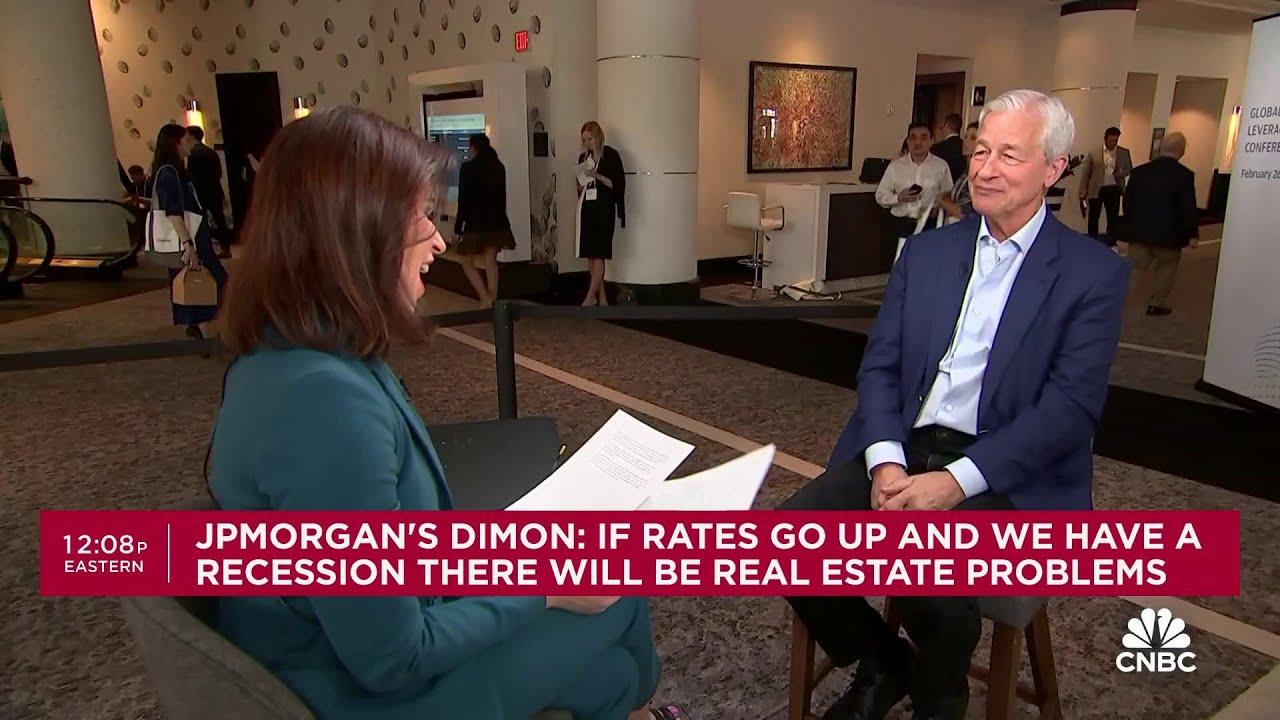

JPMorgan CEO Jamie Dimon on state of the US economy, commercial real estate risks and AI hype

Показать описание

Jamie Dimon, JP Morgan Chairman and CEO, joins Halftime Report live to discuss the market, real estate, lending and more.

JPMorgan CEO Jamie Dimon on bitcoin: My personal advice is don't get involved

Jamie Dimon, Chairman, President, and CEO of JPMorgan Chase

JPMorgan CEO Jamie Dimon on Inflation, Markets, Fed, China, India

JPMorgan CEO Jamie Dimon on state of the US economy, commercial real estate risks and AI hype

When JPMorgan CEO Jamie Dimon Speaks, the World Listens | The Circuit

JPMorgan CEO Jamie Dimon: If you don't control the borders you're going to destroy our cou...

Why JPMorgan CEO Jamie Dimon Is Skeptical of an Economic Soft Landing | WSJ

JPMorgan CEO Jamie Dimon on China, US Debt-Limit, AI

JP Morgan Chase CEO Jamie Dimon delivers stark warning on inflation and economy

“PM Modi Doing An Unbelievable Job”, Says JP Morgan CEO Jamie Dimon

Disney’s Bob Iger and JPMorgan Chase’s Jamie Dimon on Leadership

JPMorgan CEO Jamie Dimon on the Fed: We lost control of inflation

How Jamie Dimon Built Chase Into the U.S.’s Most Powerful Bank | WSJ

JPMorgan CEO Jamie Dimon wants to be Trump's Treasury secretary: O’Leary | The Hill

JPMorgan CEO Jamie Dimon comments on the debt ceiling

The David Rubenstein Show: JPMorgan CEO Jamie Dimon

Exclusive interview with JP Morgan Chase & Co. CEO Jamie Dimon

JPMorgan CEO Jamie Dimon on 2024 election: Help Nikki Haley 'even if you're a very liberal...

Jamie Dimon's Career Advice

Elizabeth Warren questions JPMorgan Chase CEO Jamie Dimon on potential for Zelle fraud

JPMorgan CEO Jamie Dimon on IPOs, AI, 3-Day Work Weeks, 8% Interest Rates (Full interview)

CEO Conversations: Jamie Dimon, JPMorgan Chase & Co.

JPMorgan Chase CEO Jamie Dimon on 'Face the Nation with Margaret Brennan' | full interview

JAMIE DIMON: CEO di JPMORGAN e banchiere PIU' POTENTE al MONDO

Комментарии

0:06:29

0:06:29

0:57:19

0:57:19

0:15:37

0:15:37

0:08:06

0:08:06

0:22:32

0:22:32

0:07:47

0:07:47

0:12:56

0:12:56

0:19:07

0:19:07

0:00:32

0:00:32

0:00:59

0:00:59

0:16:11

0:16:11

0:02:20

0:02:20

0:07:07

0:07:07

0:05:27

0:05:27

0:01:17

0:01:17

0:24:26

0:24:26

0:12:56

0:12:56

0:04:03

0:04:03

0:03:31

0:03:31

0:01:00

0:01:00

0:16:00

0:16:00

0:25:59

0:25:59

0:34:56

0:34:56

0:19:29

0:19:29