filmov

tv

All-Weather VS. Permanent Portfolio - Which is BETTER?

Показать описание

Today we match up the All-Weather VS Permanent Portfolio to determine which of these strategies is the best low risk high return investments (crash proof portfolios). When the market is booming most people put everything into stocks and then when the inevitable crash occurs, they sell their stocks for a huge loss and buy bonds. This losing formula is consistently repeated time and time again over the decades. Luckily for educated investors, who want a safer method of investing, there are portfolios out there that perform well in any economic condition. Today we will be investigating two of those portfolios (the safest medium risk portfolios), Ray Dalio's All-Weather (All-Seasons) Portfolio and Harry Browne's Permanent Portfolio.

Note that by low risk high return we do not mean SAFE, just much safer than traditionally constructed portfolios.

Chapters:

0:00 Introduction

0:48 The Simpsons 'In the Money' Clip

1:23 Investment Risk Categories

1:39 Ray Dalio All-Weather Portfolio

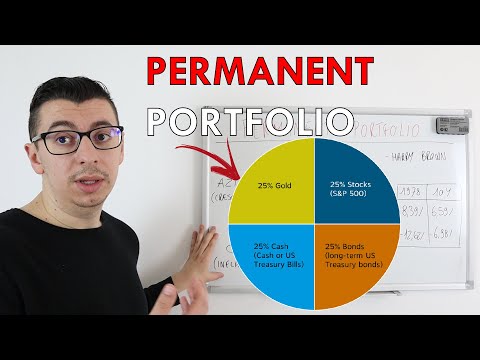

2:49 Harry Browne Permanent Portfolio

3:33 Backtest Results

5:14 Safest Portfolio Winner

--------------

Donations

--------------

Bitcoin: 37y3Twv4QK4wJSDh2UQ4simNTNxUKq486s

Ethereum: 0x825bc708e876897ec9320bf6601df66f00ce26bb

USDC: 0x825bc708e876897ec9320bf6601df66f00ce26bb

--------------

Our Most Popular Videos

--------------

--------------

Portfolios featured in this episode

--------------

Invest in the Harry Browne "Permanent Portfolio"

Invest in the Ray Dalio "All-Seasons Portfolio"

--------------

Stock Brokerages

--------------

Robinhood Brokerage (Get 2 free stocks!)

M1 Finance (Free Trading) Brokerage Account (Affiliate Link) - OPTIONS TRADING NOT ALLOWED

--------------

Audio Clip Credits

--------------

No third-party audio clips were used during this video

--------------

**Amazon Affiliate Links**

Books Relevant to this discussion:

#Portfolios #Investing #Stocks

Note that by low risk high return we do not mean SAFE, just much safer than traditionally constructed portfolios.

Chapters:

0:00 Introduction

0:48 The Simpsons 'In the Money' Clip

1:23 Investment Risk Categories

1:39 Ray Dalio All-Weather Portfolio

2:49 Harry Browne Permanent Portfolio

3:33 Backtest Results

5:14 Safest Portfolio Winner

--------------

Donations

--------------

Bitcoin: 37y3Twv4QK4wJSDh2UQ4simNTNxUKq486s

Ethereum: 0x825bc708e876897ec9320bf6601df66f00ce26bb

USDC: 0x825bc708e876897ec9320bf6601df66f00ce26bb

--------------

Our Most Popular Videos

--------------

--------------

Portfolios featured in this episode

--------------

Invest in the Harry Browne "Permanent Portfolio"

Invest in the Ray Dalio "All-Seasons Portfolio"

--------------

Stock Brokerages

--------------

Robinhood Brokerage (Get 2 free stocks!)

M1 Finance (Free Trading) Brokerage Account (Affiliate Link) - OPTIONS TRADING NOT ALLOWED

--------------

Audio Clip Credits

--------------

No third-party audio clips were used during this video

--------------

**Amazon Affiliate Links**

Books Relevant to this discussion:

#Portfolios #Investing #Stocks

Комментарии

0:05:57

0:05:57

0:35:41

0:35:41

0:06:04

0:06:04

0:10:43

0:10:43

0:09:14

0:09:14

0:14:14

0:14:14

0:08:39

0:08:39

0:11:08

0:11:08

0:02:53

0:02:53

0:10:42

0:10:42

0:11:21

0:11:21

0:09:37

0:09:37

0:07:46

0:07:46

0:15:57

0:15:57

0:06:36

0:06:36

0:15:29

0:15:29

0:26:03

0:26:03

0:00:59

0:00:59

0:14:57

0:14:57

0:05:39

0:05:39

0:05:12

0:05:12

0:13:57

0:13:57

0:02:08

0:02:08

0:11:57

0:11:57