filmov

tv

The #1 Problem With Dividend Growth Investing! (No One Admits THIS)

Показать описание

📈 Please Like Comment and Subscribe!

📈 SUBSCRIBE - @StockMarketBeast

📈 Hi and welcome to my channel!

The #1 Problem With Dividend Growth Investing! (No One Admits THIS)

*I am not a financial advisor, I make these videos for fun! This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

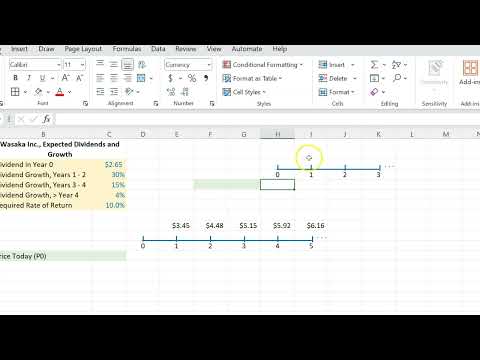

SCHD, dividend,dividend investing,dividend ratio,yield on cost,yield on cost explained,dividend yield,dividend yield explained,dividend yield on cost,dividend yield on cost explained,investing,money,passive income,robinhood,robinhood portfolio,robinhood investing,intelligent money investing,dividends,passive dividend income,passive income with dividends,dividend growth,dividend growth investing,the importance of yield on cost,yoc,yield,etf,stock,abbvie,abbvie stock

#Dividends #dividendinvesting

Комментарии

0:09:18

0:09:18

0:00:48

0:00:48

0:15:14

0:15:14

0:12:56

0:12:56

0:30:12

0:30:12

0:14:49

0:14:49

0:11:39

0:11:39

0:12:19

0:12:19

0:24:41

0:24:41

0:11:01

0:11:01

0:01:00

0:01:00

0:14:24

0:14:24

0:16:28

0:16:28

0:01:00

0:01:00

0:16:41

0:16:41

0:16:40

0:16:40

0:02:05

0:02:05

0:05:57

0:05:57

0:18:02

0:18:02

1:01:47

1:01:47

0:05:04

0:05:04

0:00:54

0:00:54

0:31:08

0:31:08

0:19:44

0:19:44