filmov

tv

The 1-3-6 Method For Building & Managing Your Emergency Fund

Показать описание

In this episode of the Personal Finance Podcast, we're going to talk about the 1-3-6 method for building your emergency fund.

How Andrew Can Help You:

Thanks to Our Amazing Sponsors for supporting The Personal Finance Podcast.

Monarch Money: Get an extended 30 day free trial at monarchmoney/pfp

Links Mentioned in this Episode:

Latest Podcast Videos:

Connect With Andrew on Social Media:

Free Guides:

How Andrew Can Help You:

Thanks to Our Amazing Sponsors for supporting The Personal Finance Podcast.

Monarch Money: Get an extended 30 day free trial at monarchmoney/pfp

Links Mentioned in this Episode:

Latest Podcast Videos:

Connect With Andrew on Social Media:

Free Guides:

The 1-3-6 Method For Building & Managing Your Emergency Fund

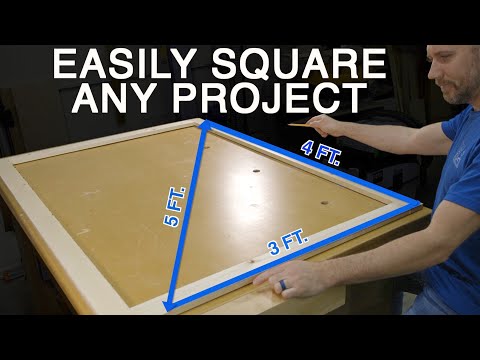

3-4-5 Method

How many reps for muscle growth?

STOP increasing the WEIGHT during your SETS!

✅ 3-4-5 METHOD 🔥 How To MAKE a PERFECT Right Angle

3-4-5 Triangle Method For Finding Square

3-4-5 Squaring Method, Easy Way To Check! #construction

How to Answer Any Question on a Test

Infinite chocolate trick explained

What to Do if You Didn’t Study

NEWYES Calculator VS Casio calculator

3-4-5 method to find square for large spaces

Bro’s hacking life 😭🤣

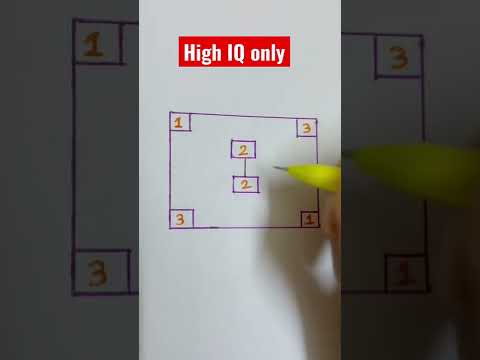

Connect 1 to 1, 2 to 2, 3 to 3 without crossing the lines! For High IQ only

MMA MIG welding method and technique video teaching

Save 5,000-10,000 A Year By Following This Simple Method

Build Your 6 Figure Coaching Empire In 2025 Through WhatsApp Course | Coaching Business Strategy

3-4-5 Method, How to get a perfect right angle when building structures.

🤗Easy Trick to Learn Table of 19/Multiplication Table of 19/Maths Tables/Pahada #shorts #shortsfeed...

Does This 100 Year Old Digging Technique Make Any Sense? #shorts

how to study the bible using SOAP method.

Tamasha Dekho 😂 IITian Rocks Relatives Shock 😂😂😂 #JEEShorts #JEE #Shorts

3 Great Tips for Block-work | Build A Foundation

The Best Bazaar Money Making Method Flip On Hypixel Skyblock...

Комментарии

0:38:53

0:38:53

0:03:20

0:03:20

0:00:41

0:00:41

0:00:27

0:00:27

0:04:24

0:04:24

0:05:49

0:05:49

0:00:40

0:00:40

0:00:27

0:00:27

0:00:48

0:00:48

0:00:27

0:00:27

0:00:14

0:00:14

0:00:55

0:00:55

0:00:20

0:00:20

0:00:26

0:00:26

0:00:16

0:00:16

0:00:36

0:00:36

0:01:24

0:01:24

0:04:24

0:04:24

0:00:16

0:00:16

0:00:35

0:00:35

0:00:50

0:00:50

0:00:13

0:00:13

0:03:00

0:03:00

0:00:39

0:00:39