filmov

tv

Tesla: A Story Stock but what's the story?

Показать описание

Tesla is a story stock, i.e., a stock whose value and price are driven more by the story told about the stock and changes to that story than the numbers that you see the company reporting. In this webcast, I look at how different story lines play out as valuations of Tesla and why you my choose one over the other.

Tesla: A Story Stock but what's the story?

How Tesla’s ‘story’ is driving its skyrocketing stock value

The Rise And Fall Of Tesla Stock

Tesla Cars Got Hacked 🤯 | Leave The World Behind #shorts

Dissent and Debate: Pushback on my Tesla Valuation!

Revisiting Tesla in January 2023: The Great Unraveling or a Return to Normalcy?

Charlie Munger: BYD so ahead of Tesla in China it's 'almost ridiculous' #Shorts

Tesla: 8 Ways to an $8,000 Share Price

A Do-it-Yourself (DIY) Valuation of Tesla: Of Investment Regret and Disagreement!

Tesla at a Trillion-Dollar Market Cap: Revisiting its Valuation

Investor Beware - The Dangers of Tesla's Stock

Why Robert Kiyosaki Says 'No' To Apple And Tesla And 'Yes' To Gold!

Elon Musk Regrets Selling Tesla Stocks For Twitter

Tesla Stock: Bull Case vs Bear Case | Full Documentary

Tesla Sells Bitcoin Holdings #shorts

Here's What's in Store for Tesla in 2023

Elon Musk's New Historic Speech That's Making Liberals Mad

Tesla Stock is CHEAPER Than Coke or Pepsi (Seriously) #TSLA

Since Musk's Twitter takeover, Tesla suffers a $250 billion market cap loss

Why is Tesla not coming to India? | Real Reason

🔍 Why Tesla's Stock Price is so LOW📉!

Tesla Cybertruck Crash Test - BeamNG.Drive #shorts

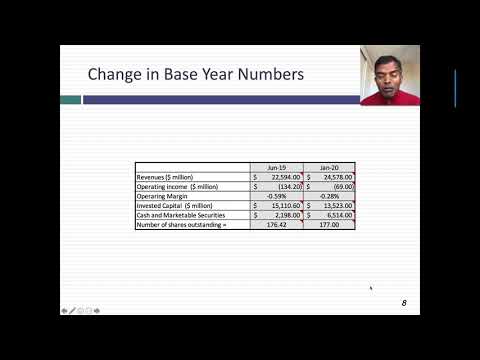

An Ode to Luck: Revisiting Tesla in January 2020

Tesla is the most undervalued AI name in the market, says Wedbush's Dan Ives

Комментарии

0:20:14

0:20:14

0:05:23

0:05:23

0:14:18

0:14:18

0:00:49

0:00:49

0:25:55

0:25:55

0:27:40

0:27:40

0:00:58

0:00:58

0:23:22

0:23:22

0:19:51

0:19:51

0:30:41

0:30:41

0:15:13

0:15:13

0:00:28

0:00:28

0:00:55

0:00:55

0:33:22

0:33:22

0:00:30

0:00:30

0:00:55

0:00:55

0:51:35

0:51:35

0:07:30

0:07:30

0:00:15

0:00:15

0:01:00

0:01:00

0:19:50

0:19:50

0:00:22

0:00:22

0:17:57

0:17:57

0:05:55

0:05:55