filmov

tv

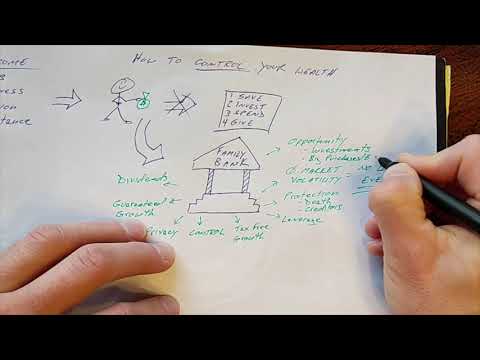

Infinite Banking Strategy - Be Your Own Bank

Показать описание

This is the very popularized Infinite Banking Strategy! While there are a lot more nuances that go into actually executing this strategy, but this is the gist of it. Let me know what you guys think!

If you want to know more about this strategy - message me directly. I can refer you to a few of my colleagues that offer these products.

FOLLOW CHRISTIAN:

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

#taxes #business #s-corp

If you want to know more about this strategy - message me directly. I can refer you to a few of my colleagues that offer these products.

FOLLOW CHRISTIAN:

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Links above include affiliate commission or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

#taxes #business #s-corp

The Infinite Banking Concept explained

Learn how the infinite banking strategy actually works.

Why Infinite Banking is a SCAM!

The Easiest Infinite Banking Strategy Explained (2025)

What Does a Model Infinite Banking Strategy Look Like? | Infinite Banking Example

The Best Infinite Banking Strategy!

Using the Infinite Banking Strategy to Set You Up for Retirement

How To Use Whole Life Insurance To Build Wealth | Infinite Banking

Whole Life Insurance & Infinite Banking. Product Choice, Design, and How Loans Work

Banking Secrets: Is Infinite Banking Superior? 🏦💰

How Much Money Do You Need for Infinite Banking Concept? | Infinite Banking with Chris Miles

How I How I Use the Infinite Banking Strategy in My Own Life...

The Infinite Banking System Explained (Full Breakdown!)

Using XRP to Become Your Own Bank with Infinite Banking

Managing Assets With The Infinite Banking Concept

Infinite Banking Concept Explained [For Dummies]

Infinite Banking Strategy - Be Your Own Bank

How Do I Start Infinite Banking | with Chris Naugle

Flip, Save, Invest: Matt and Nicole's Infinite Banking Strategy

Is Infinite Banking The Right Strategy For You?

Combine Infinite Banking With Velocity Banking

Growing Your Capital: Infinite Banking Strategies - Part 1

How to Build Wealth with Infinite Banking: The Step-by-Step Guide

Can I set up an Infinite Banking Strategy for my kids?

Комментарии

0:04:27

0:04:27

0:01:00

0:01:00

0:09:17

0:09:17

0:06:05

0:06:05

0:05:44

0:05:44

0:58:10

0:58:10

0:05:42

0:05:42

0:01:00

0:01:00

0:29:57

0:29:57

0:00:49

0:00:49

0:10:36

0:10:36

0:00:20

0:00:20

0:21:22

0:21:22

0:08:58

0:08:58

0:00:53

0:00:53

0:22:46

0:22:46

0:00:50

0:00:50

0:10:19

0:10:19

0:06:15

0:06:15

0:01:20

0:01:20

0:00:43

0:00:43

0:24:29

0:24:29

0:04:59

0:04:59

0:00:55

0:00:55