filmov

tv

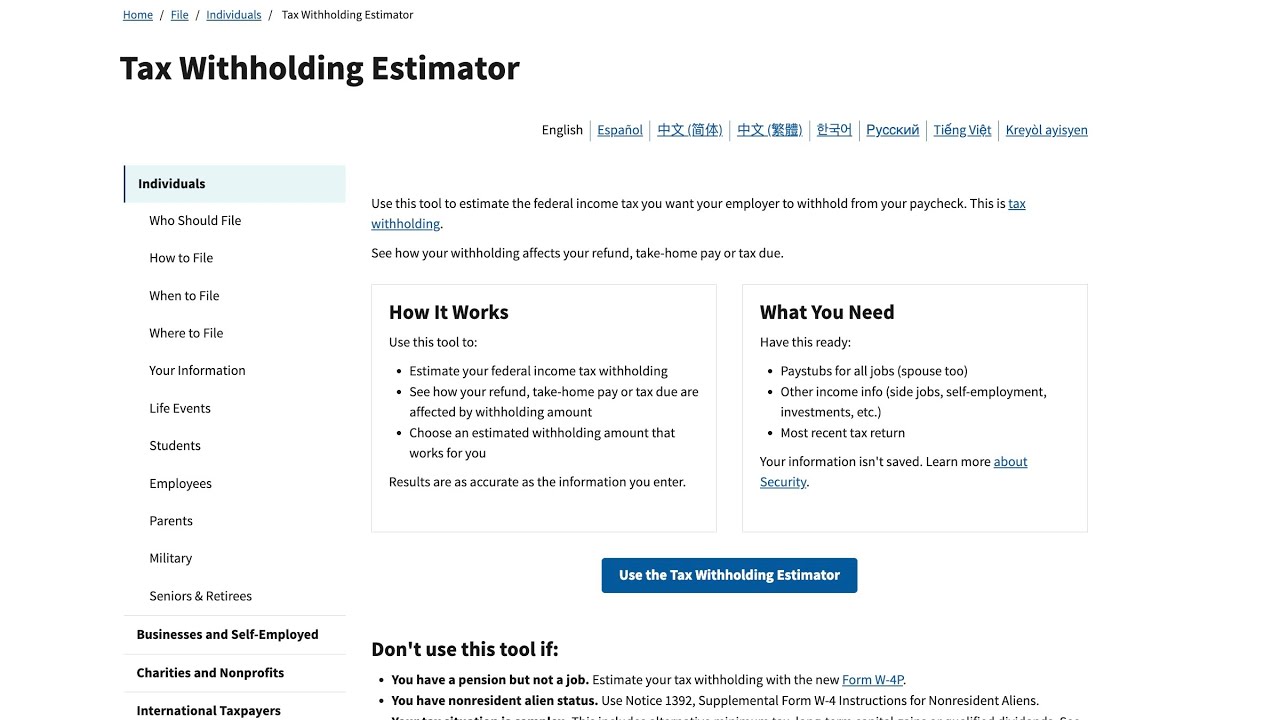

How to use the IRS Tax Withholding Estimator Tool (A walkthrough)

Показать описание

Use this tax tool to help your tax withholding selections on one of the following:

IRS Form W-4, Employee’s Withholding Certificate

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments

How to Create an Account to use IRS Free File Fillable Forms

Filing Information Returns Electronically with the IRS

How you could file taxes for free, through the IRS

Here’s How to use the Find Your IRS Free File Trusted Partner Tool

How the IRS catches you for Tax Evasion

IRS Receipt Requirements: How to Substantiate Any Tax Write Off

How to make a tax payment online to the IRS

How to File Taxes for Free 2024 | IRS Free File

IRS free tax filing software launches Friday, Jan. 10 | Are you eligible?

How to Pay ZERO TAXES to The IRS: Tax Loopholes You Can Use!

How to apply for a payment plan online with the IRS

How to Use the IRS Sales Tax Deduction Calculator walkthrough (Schedule A)

How to Get IRS Transcripts Online

How to use the IRS Tax Withholding Estimator Tool (A walkthrough)

What the IRS is actually looking for that could trigger a tax audit

IRS Tax Return Transcripts Explained | How to Get Them Online

What happens when you call the IRS to setup a payment plan #backtaxes #taxhelp #irs #taxattorney

IRS Direct File could help you next tax season. Here's how.

How could IRS use AI to detect individuals who don't pay taxes? | Morning in America

IRS Form W4 TAX ADJUSTMENT

How to fill out IRS form W4 Married Filing Jointly 2023

A Former IRS Agent Shares What It's Like to Work at the IRS

IRS Data Retrieval Tool (2016-1017)

STEP-BY-STEP the Best Way to PAY the IRS Online? (EFTPS vs. IRS Direct Pay)

Комментарии

0:01:05

0:01:05

0:00:42

0:00:42

0:00:48

0:00:48

0:01:02

0:01:02

0:00:54

0:00:54

0:13:27

0:13:27

0:05:49

0:05:49

0:07:07

0:07:07

0:00:23

0:00:23

0:12:37

0:12:37

0:03:20

0:03:20

0:11:50

0:11:50

0:03:32

0:03:32

0:20:13

0:20:13

0:04:16

0:04:16

0:05:52

0:05:52

0:00:58

0:00:58

0:02:54

0:02:54

0:05:07

0:05:07

0:09:13

0:09:13

0:10:56

0:10:56

0:05:21

0:05:21

0:01:51

0:01:51

0:08:52

0:08:52