filmov

tv

Aging of Receivables Method Explained

Показать описание

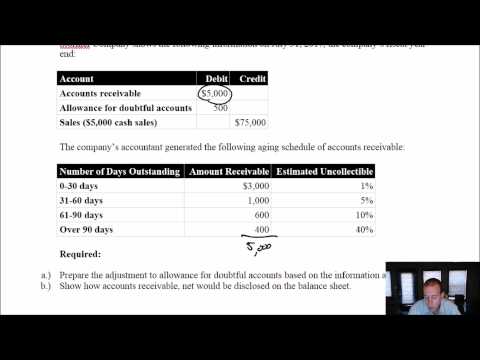

In this video, we explore the aging of receivables method, a crucial tool for estimating the allowance for doubtful accounts. This technique is similar to the percent of receivables method, but uses varying percentages based on how long an account receivable is overdue.

This method categorizes each account receivable by its due date. The longer an amount is past due, the more likely it is to be uncollectible, and consequently, we assign a higher percentage of uncollectibility.

We take you through a detailed example, explaining how different percentages are applied based on the duration of overdue payment. From receivables that are not past due, to those over 90 days overdue, we provide a clear understanding of how to estimate the allowance for doubtful accounts.

The video further discusses how to adjust the allowance for doubtful accounts to reach the desired balance, whether the unadjusted balance is a credit or a debit. These practical examples provide a thorough understanding of how to debit bad debts expense and credit allowance for doubtful accounts.

This video is perfect for accounting students looking to deepen their understanding of accounts receivable and the aging of receivables method. By the end of the video, you will have a comprehensive understanding of this method and how to apply it effectively in your accounting practices.

Remember to like this video if you find it helpful and share it with your classmates. Subscribe to our channel for more videos that make complex accounting concepts easy to understand!

Jonathan M. Wild

#accounting #accountsreceivable #baddebts #accountingtutorial #accountingbasics

This method categorizes each account receivable by its due date. The longer an amount is past due, the more likely it is to be uncollectible, and consequently, we assign a higher percentage of uncollectibility.

We take you through a detailed example, explaining how different percentages are applied based on the duration of overdue payment. From receivables that are not past due, to those over 90 days overdue, we provide a clear understanding of how to estimate the allowance for doubtful accounts.

The video further discusses how to adjust the allowance for doubtful accounts to reach the desired balance, whether the unadjusted balance is a credit or a debit. These practical examples provide a thorough understanding of how to debit bad debts expense and credit allowance for doubtful accounts.

This video is perfect for accounting students looking to deepen their understanding of accounts receivable and the aging of receivables method. By the end of the video, you will have a comprehensive understanding of this method and how to apply it effectively in your accounting practices.

Remember to like this video if you find it helpful and share it with your classmates. Subscribe to our channel for more videos that make complex accounting concepts easy to understand!

Jonathan M. Wild

#accounting #accountsreceivable #baddebts #accountingtutorial #accountingbasics

0:04:07

0:04:07

0:02:48

0:02:48

0:08:37

0:08:37

0:04:40

0:04:40

0:02:38

0:02:38

0:11:37

0:11:37

0:06:02

0:06:02

0:09:55

0:09:55

0:07:38

0:07:38

0:13:35

0:13:35

0:01:06

0:01:06

0:10:42

0:10:42

0:11:48

0:11:48

0:04:43

0:04:43

0:11:12

0:11:12

0:01:06

0:01:06

0:12:16

0:12:16

0:02:53

0:02:53

0:06:30

0:06:30

0:05:41

0:05:41

0:11:25

0:11:25

0:10:04

0:10:04

0:06:27

0:06:27

0:11:31

0:11:31