filmov

tv

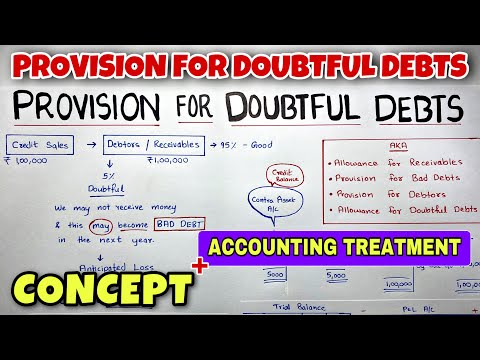

Allowance For Doubtful Accounts Explained with Examples

Показать описание

Join 10,000+ professionals who enrolled in the Controller Academy 🚀

[coupon 30OFFCOURSE for 30% discount]

Or

Get my Controller bundle, which includes the Controller Academy

[coupon 30OFFCOURSE for 30% discount]

Download the Excel template shown in this video:

What we cover in this video:

Why do we record an allowance for doubtful accounts?

What are the methods used in the calculations?

And toward the end of the video, I’ll show you how to choose a method and what audit support you’re gonna need.

-----------------------------------

Hang Out with me on social media:

DISCLAIMER: Links included in this description might be affiliate links. If you happen to purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

All views expressed on my channel are mine alone. Not intended as financial or professional advice

[coupon 30OFFCOURSE for 30% discount]

Or

Get my Controller bundle, which includes the Controller Academy

[coupon 30OFFCOURSE for 30% discount]

Download the Excel template shown in this video:

What we cover in this video:

Why do we record an allowance for doubtful accounts?

What are the methods used in the calculations?

And toward the end of the video, I’ll show you how to choose a method and what audit support you’re gonna need.

-----------------------------------

Hang Out with me on social media:

DISCLAIMER: Links included in this description might be affiliate links. If you happen to purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

All views expressed on my channel are mine alone. Not intended as financial or professional advice

Allowance For Doubtful Accounts Explained with Examples

Allowance For Doubtful Accounts - Accounts Receivable

Allowances for Doubtful Accounts - Accounting

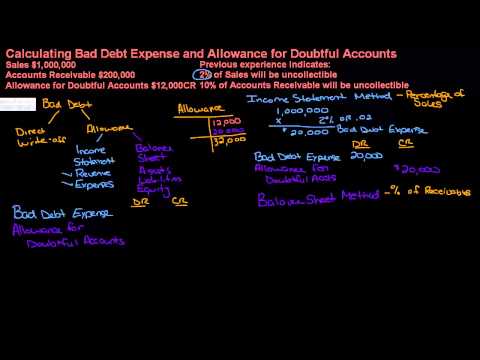

Calculating Bad Debt Expense and Allowance for Doubtful Accounts

Bad debt accounting

How to use the Allowance Method

FA25 - How do you Write Off a Receivable?

Allowance For Doubtful Accounts | Bad Debt Expenses | FINANCIAL ACCOUNTING BASICS

Allowance for Doubtful Accounts and Bad Debt Expense

Allowance for Doubtful Accounts Explained

Allowance Method for Uncollectible Accounts | Principles of Accounting

Allowance for Doubtful Accounts and Accounts Receivable

Allowance for Doubtful Accounts 101

Allowance for Doubtful Accounts: Example 1, 101

Doubtful Debts vs Bad Debts

FA22 - Accounts Receivable Explained

IRRECOVERABLE DEBTS AND ALLOWANCES (BAD DEBTS AND PROVISIONS) - PART 1

What Do I Do with a Debit Balance in the Allowance for Doubtful Accounts?

Bad Debts and Recovery of Bad Debts - By Saheb Academy

#1 Provision for Doubtful Debts - Bad Debts - By Saheb Academy

Financial statements | bad debts and provision for doubtful debts | most important adjustment.

Bad Debts & Allowance For Doubtful Accounts (Provision for bad debts) In Financial Statements

Effect of Bad debts and provision for Doubtful debts: #shortvideo #youtubeshorts

Credit Losses, Bad debts, Allowance for Bad debts, allowance for credit losses. #Unisa #Fac 1502

Комментарии

0:10:04

0:10:04

0:05:06

0:05:06

0:04:55

0:04:55

0:17:10

0:17:10

0:08:30

0:08:30

0:04:29

0:04:29

0:04:02

0:04:02

0:09:19

0:09:19

0:02:22

0:02:22

0:09:40

0:09:40

0:04:37

0:04:37

0:02:22

0:02:22

0:00:46

0:00:46

0:00:43

0:00:43

0:01:00

0:01:00

0:10:42

0:10:42

0:27:22

0:27:22

0:04:52

0:04:52

0:12:43

0:12:43

1:05:48

1:05:48

0:12:00

0:12:00

0:06:42

0:06:42

0:00:20

0:00:20

0:15:04

0:15:04