filmov

tv

Aging of Accounts Method

Показать описание

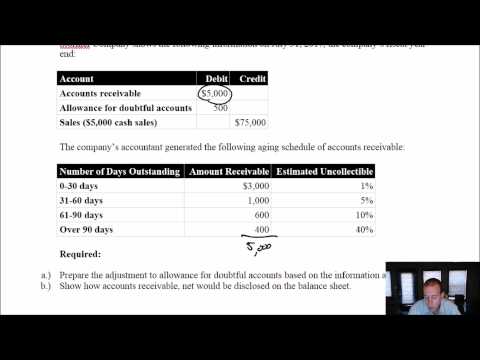

The aging of accounts method is similar to the percentage of accounts receivable method.

The only difference is it looks at how long it takes customers to pay. A general rule is the longer an accounts receivable remains unpaid, it will default.

To start, you will need to have an aging of accounts receivable report. Accounting software can generate this report for you.

You need to enter your totals for each column and it will estimate the amounts.

I filled out the worksheet with my data, which estimated $11.

This means for example, if I sold $1,000 of products on credit, $11 of that total might become bad debt.

Use the estimated amount that's generated so you can use it in your contra-asset account when calculating bad debt.

The only difference is it looks at how long it takes customers to pay. A general rule is the longer an accounts receivable remains unpaid, it will default.

To start, you will need to have an aging of accounts receivable report. Accounting software can generate this report for you.

You need to enter your totals for each column and it will estimate the amounts.

I filled out the worksheet with my data, which estimated $11.

This means for example, if I sold $1,000 of products on credit, $11 of that total might become bad debt.

Use the estimated amount that's generated so you can use it in your contra-asset account when calculating bad debt.

0:04:07

0:04:07

0:02:48

0:02:48

0:11:37

0:11:37

0:08:37

0:08:37

0:04:40

0:04:40

0:01:06

0:01:06

0:04:43

0:04:43

0:02:38

0:02:38

0:11:25

0:11:25

0:04:45

0:04:45

0:06:27

0:06:27

0:06:02

0:06:02

0:09:15

0:09:15

0:12:39

0:12:39

0:11:48

0:11:48

0:02:00

0:02:00

0:07:38

0:07:38

0:08:35

0:08:35

0:10:01

0:10:01

0:13:35

0:13:35

0:05:41

0:05:41

0:15:20

0:15:20

0:25:47

0:25:47

0:04:37

0:04:37