filmov

tv

Microsoft's quarter was messy with Azure miss, AI trade still intact, says Deepwater's Gene Munster

Показать описание

Gene Munster, Deepwater Asset Management, joins 'Fast Money' to talk Microsoft earnings.

Chinese President Xi Jinping confronts Justin Trudeau at G20 | USA TODAY #Shorts

Microsoft's controversial plan to SAVE Xbox!

How to cut shape in powerpoint?

I Survived the World's Quietest Room

Scam Shops in Pakistan & India - Don't Be Fooled!

Excel Pivot Tables: How to Group Dates into Years and Months

What's the hardest piano piece? (TW: blood)

Rich Student vs Broke Student

'Basics in Behavior' | Baldi's Basics Animated Minecraft Music Video

Here's Why Barbara Corcoran Was FIRED From Shark Tank..

How to fix date format for X-axis in Excel chart

I Survived Sensory Deprivation

How to make Summary Report in Excel within 2 minutes, How to Summarize Data in Excel

The Excel SUMIFS Function

Advanced Pivot Table Techniques (to achieve more in Excel)

Inside Microsoft's Insane Headquarters

Stephen Sharer - When I See You Again (Official Music Video)

Microsoft's 3 Biggest Mistakes

A Boogie Wit Da Hoodie - Drowning [Official Music Video]

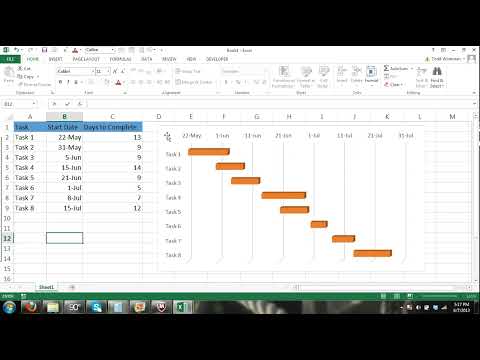

Gantt Chart Excel Tutorial - How to make a Basic Gantt Chart in Microsoft Excel

Why Planes Don't Fly Over the Pacific Ocean

How to Add MULTIPLE Sets of Data to ONE GRAPH in Excel

The DEI Disaster | 5-Minute Videos

How To Scale Windows To Fit Your TV: (Easy Fix)

Комментарии

0:00:43

0:00:43

0:16:51

0:16:51

0:00:45

0:00:45

0:08:05

0:08:05

0:00:43

0:00:43

0:01:02

0:01:02

0:00:25

0:00:25

0:10:41

0:10:41

0:04:18

0:04:18

0:10:20

0:10:20

0:02:19

0:02:19

0:08:15

0:08:15

0:07:37

0:07:37

0:06:12

0:06:12

0:11:47

0:11:47

0:10:15

0:10:15

0:03:07

0:03:07

0:30:01

0:30:01

0:03:58

0:03:58

0:08:14

0:08:14

0:08:47

0:08:47

0:03:44

0:03:44

0:05:45

0:05:45

0:01:34

0:01:34