filmov

tv

When Should You Issue 1099-MISC Tax Form - Tax Help

Показать описание

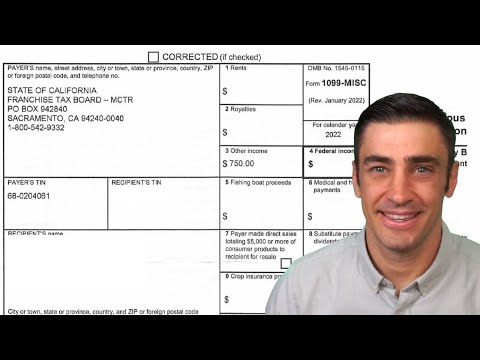

Do you need to issue a 1099-MISC form to a vendor or contractor this year?

Form 1099-MISC for Miscellaneous Income, is used to report payments for services performed for a business by people not treated as its employees, such as payments to subcontractors, rent payments or prizes. A 1099-MISC form must be provided to the recipient and a copy mailed to or E-Filed with the IRS.

Greetings and thanks for checking out this channel.

Mrs. Balance Sheet is about one woman’s struggle to juggle FAITH, FAMILY, FINANCE & FITNESS.

Name channel name says it all.

Mrs – I’m a devoted wife, full-time mom of 3 girls and I love Jesus and keeping my home beautiful.

Balance Sheet – I’m an accountant, investor, landlord, expert business consultant.

After getting my bachelor’s degree in accounting and master’s degree in business I spent 10 years climbing the infamous corporate ladder only to discover God had another direction for me. Ultimately, I retired from corporate America at 32 yrs. and have been blessed abundantly since then. I am active CPA candidate. I hate having regrets, so after losing my credit for passing part of the exam almost 10 years ago, I back at it.

AUD 81

BEC 79

REG 77

FAR May 2018

#tax

#buildwealth

#youtubeblack

#money

Serious Business Inquiries only:

Form 1099-MISC for Miscellaneous Income, is used to report payments for services performed for a business by people not treated as its employees, such as payments to subcontractors, rent payments or prizes. A 1099-MISC form must be provided to the recipient and a copy mailed to or E-Filed with the IRS.

Greetings and thanks for checking out this channel.

Mrs. Balance Sheet is about one woman’s struggle to juggle FAITH, FAMILY, FINANCE & FITNESS.

Name channel name says it all.

Mrs – I’m a devoted wife, full-time mom of 3 girls and I love Jesus and keeping my home beautiful.

Balance Sheet – I’m an accountant, investor, landlord, expert business consultant.

After getting my bachelor’s degree in accounting and master’s degree in business I spent 10 years climbing the infamous corporate ladder only to discover God had another direction for me. Ultimately, I retired from corporate America at 32 yrs. and have been blessed abundantly since then. I am active CPA candidate. I hate having regrets, so after losing my credit for passing part of the exam almost 10 years ago, I back at it.

AUD 81

BEC 79

REG 77

FAR May 2018

#tax

#buildwealth

#youtubeblack

#money

Serious Business Inquiries only:

Комментарии

0:11:08

0:11:08

0:07:02

0:07:02

0:11:46

0:11:46

0:01:37

0:01:37

0:08:26

0:08:26

0:02:55

0:02:55

0:01:45

0:01:45

0:03:50

0:03:50

0:08:22

0:08:22

0:05:07

0:05:07

0:01:17

0:01:17

0:01:32

0:01:32

0:05:19

0:05:19

0:01:42

0:01:42

0:06:47

0:06:47

0:21:54

0:21:54

0:06:35

0:06:35

0:01:00

0:01:00

0:04:55

0:04:55

0:01:28

0:01:28

0:00:48

0:00:48

0:07:35

0:07:35

0:01:18

0:01:18

0:01:13

0:01:13