filmov

tv

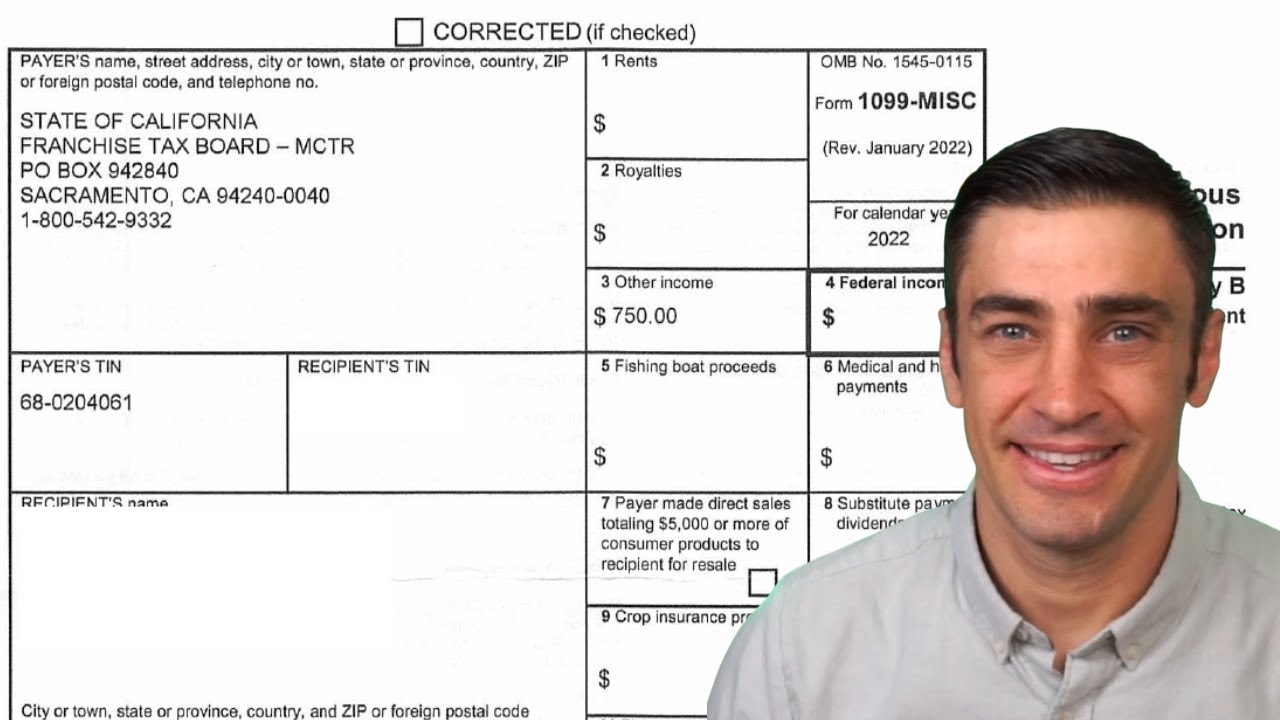

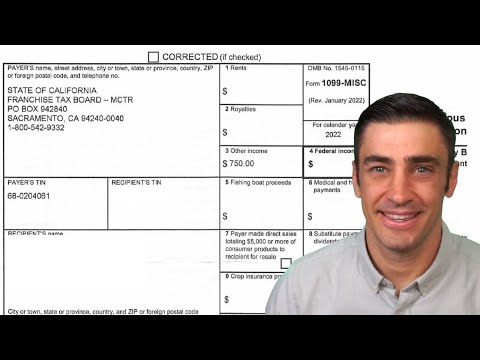

What to do with 1099 Misc from California FTB - 2022

Показать описание

If you received an IRS Form 1099-Misc from the State of California for 2022 with box 3 "other income" and wondering what this is and how it gets taxed, this video is for you!

00:00 Intro

00:14 What is the IRS Form 1099-Misc from CA for?

00:35 Do I need to pay tax on the 1099-Misc from CA FTB?

02:27 How to report the IRS Form 1099-Misc from CA on the tax return.

03:39 How to report the IRS Form 1099-Misc from CA in TurboTax.

--------------

EA Tax Phone Number: 800-245-0596

--------------

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

#IRS #1099 #MiddleClassTaxRefund

00:00 Intro

00:14 What is the IRS Form 1099-Misc from CA for?

00:35 Do I need to pay tax on the 1099-Misc from CA FTB?

02:27 How to report the IRS Form 1099-Misc from CA on the tax return.

03:39 How to report the IRS Form 1099-Misc from CA in TurboTax.

--------------

EA Tax Phone Number: 800-245-0596

--------------

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

#IRS #1099 #MiddleClassTaxRefund

10 Things You Should Know About 1099s

1099 Tax Deductions Explained (2023)

What is a 1099 Form? How to file 1099 in 2025

I'm 1099 how do i turn that into a company?

When do I need to issue a 1099?

W-2 and 1099: How Do You File Taxes When You Have Both?

How To 1099 Someone - How Do I Create, Send, File 1099s for Independent Contractors from my Business

When do I need to send a 1099 to the independent contractors that I use?

Diwali special offer white brush paint saree only 1099 shipping #saree #georgette #trending#sale

Do You Need to Issue a 1099? 1099-NEC & 1099-MISC Explained.

My Form 1099 Is Wrong - What to do Next?

What Do I Do if I Get a 1099-C?

Do I Need To Issue A 1099 To A Corporation? | What You Should Know

Do I Need to Give My Contractor a 1099? 👷

What to do with your year end 1099-NEC (Formerly 1099-MISC) | NOW WHAT?

How To Do Your Taxes If You Own Stocks (Form 1099-DIV Or 1099-COMP? Watch This!)

What to do with your 1099

What do I do if I receive a 1099-NEC?

Do I Need To Send a 1099 Tax Form?

Do I owe tax if I don't get a 1099?

What to do with 1099 Misc from California FTB - 2022

✅ How Do You Get 1099 Tax Form 🔴

What is a form 1099-NEC? What to do...

I Didn’t Get a 1099, Do I Still Have to Pay Taxes?

Комментарии

0:02:18

0:02:18

0:05:19

0:05:19

0:07:32

0:07:32

0:11:21

0:11:21

0:02:03

0:02:03

0:03:27

0:03:27

0:03:32

0:03:32

0:02:27

0:02:27

0:00:53

0:00:53

0:11:08

0:11:08

0:09:13

0:09:13

0:06:01

0:06:01

0:01:14

0:01:14

0:01:27

0:01:27

0:07:50

0:07:50

0:07:15

0:07:15

0:03:25

0:03:25

0:02:03

0:02:03

0:01:05

0:01:05

0:06:25

0:06:25

0:05:07

0:05:07

0:01:27

0:01:27

0:05:25

0:05:25

0:09:12

0:09:12