filmov

tv

When to Issue a 1099-MISC Form - TurboTax Tax Tip Video

Показать описание

Note: Beginning in 2020, the 1099-MISC has been replaced by the 1099-NEC for non-employee compensation.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Video Transcript:

Hi, I'm Arye from TurboTax with some helpful information about when to issue a 1099-MISC tax form. Do you operate a trade or business and are wondering whether you need to issue a 1099-MISC?

There are a variety of transactions that would require you to issue a 1099-MISC, but there are some more common than others.

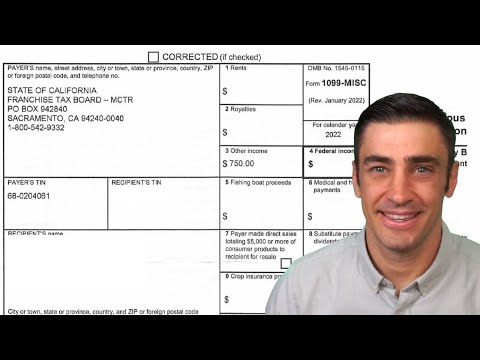

If you pay more than $600 in exchange for services, such as payments to an independent contractor or payments to a lawyer or law firm, then you would typically need to issue a 1099-MISC.

You'll also need to issue a 1099-MISC if you pay $10 or more in royalties or issue prizes and awards of $600 or more.

If you ever need to pay a lawsuit settlement other than those to compensate an individual for physical injuries or medical expenses - that’s a 1099-MISC as well.

Always remember that your payment amounts are cumulative and not on a per-payment basis. For example, if you paid a plumber to fix your sink at your office for $200 and then your shower for $500 in the same year, you would need to issue a 1099-MISC as you've paid more than $600 to them in the year.

In most cases, a copy of the 1099-MISC form is due to payment recipients by January 31st of the year immediately following the tax year in which you make the payments.

You'll need to file the 1099 with the IRS by the end of February, although you'll have until March 31st if you file it electronically.

Комментарии

0:07:02

0:07:02

0:11:08

0:11:08

0:02:55

0:02:55

0:01:37

0:01:37

0:11:46

0:11:46

0:03:50

0:03:50

0:01:17

0:01:17

0:01:54

0:01:54

0:01:32

0:01:32

0:03:06

0:03:06

0:01:28

0:01:28

0:02:35

0:02:35

0:21:54

0:21:54

0:00:48

0:00:48

0:07:17

0:07:17

0:00:49

0:00:49

0:07:35

0:07:35

0:01:13

0:01:13

0:01:28

0:01:28

0:01:00

0:01:00

0:01:42

0:01:42

0:01:18

0:01:18

0:15:44

0:15:44

0:05:07

0:05:07